This story from the Australian Aviation archives comes from November 2011, when Geoffrey Thomas wrote about the first delivery of the Boeing 787 to Japan’s All Nippon Airways (ANA) on September 26 2011.

“The bigger the innovation the more you can tolerate failure. If we had these kinds of execution problems with a product that wasn’t this innovative, we’d be in real trouble.”

Boeing chairman and chief executive Jim McNerney’s comments on the 787 execution at an IBM Think Tank Forum in New York just ahead of the delivery of the first 787 to All Nippon Airways approximately 40 months late are sobering, particularly considering that the delivery of the last game changing aircraft Boeing delivered – the 747-100 – was just two months late, despite major engine problems.

In fact Pan Am received its first 747‑100 for passenger service on December 12 1969, just 44 months after the airline’s legendary president Juan Trippe placed the launch order with Boeing’s equally famous president William (Bill) Allen.

In its editorial, Aviation Week’s then editor Robert Hotz lauded Boeing for its achievement with the 747.

“This rollout was just one day ahead of the original schedule with an aircraft 99.9 per cent complete as a flying machine. It was a tremendous achievement in what surely must be one of the most incredible achievements in American industrial history.”

While the delivery of one 787 to All Nippon Airways is a relief to Boeing, the 787’s “execution problems” are hardly over, with many analysts predicting a far slower ramp up in production than Boeing hopes.

It is a measure of the 787’s problems that unlike virtually all previous commercial aircraft programs, All Nippon Airways’ first delivery is the eighth off the line and its second is the 24th!

And in stark contrast to earlier aircraft programs, Boeing has written off the first three test aircraft and the final three will go to VIP customers.

But there is absolutely no doubt, as McNerney told his audience, Boeing has “learnt a lot from it” and the IP gain from the program is incalculable.

Production rate

But the learning experience is far from over, with the remaining 820 787s on order yet to be delivered to an increasingly impatient roster of the world’s best airlines.

New York based Bernstein Research claims that Boeing will take up to nine months longer than planned to reach a 787 production rate of 10 units per month.

Bernstein has said consistently through 2011 that it assumes “a slower production ramp than Boeing’s plan (10 per month rate reached in late 2014, rather than late 2013).”

In a September 27 report Quick Take – Boeing: 787 Signed, Sealed, Delivered – And Now? Bernstein reiterated that it “expects the production ramp to be a challenge, particularly to reach Boeing’s planned rate of 10 per month beginning in late 2013.”

It notes that “production is currently at two per month, although the plan had been to be at 2.5 per month by now. Boeing now intends to make a decision in Q4 regarding a potential rate increase to 2.5 per month. The fact that production is currently behind plan makes it even less likely that the 10/month goal will be met in 2013”.

Boeing Commercial Airplanes president James Albaugh told media at the ANA delivery that Boeing hopes to move to 3.5 aircraft a month by the US “late winter early spring.”

Bernstein believes that Boeing will deliver eight 787s this year, compared to the manufacturer’s target of between 12 and 20, 61 in 2012, 78 in 2013 and 107 in 2014. It notes that Boeing is working on an additional Dreamliner surge line in Everett that, combined with the existing line and the new North Charleston (South Carolina) line, could lift the 787 production rate to 17 a month by 2016. The Everett surge line will be operational in early 2012.

However, McNerney insisted at the handover of the first 787 that “we have a robust plan. We’ve got a surge line here in Everett. We’ve got a factory in South Carolina to bolster the core of it. We have healed up our partners’ production processes”.

“We have a plan to be at 10 787s a month by the end of 2013 and we have confidence we can make it,” McNerney said.

However, Bernstein’s more downbeat 787 production ramp up forecast is supported by airlines such as Air New Zealand, launch customer for the 787-9. In July Air New Zealand CFO Rob McDonald told an Aviation Outlook conference in Sydney that delivery of the 787-9 has been pushed into 2014.

“It would be an understatement to say we are frustrated and disappointed [by the 787 delays],” McDonald said. “We are in discussions with Boeing around delivery dates and the financial implications of that.”

Qantas Group CFO Gareth Evans told Australian Aviation in August that the airline does not expect to get its first 787-8, to be operated by subsidiary Jetstar, until the first quarter of 2013 rather than late 2012 as scheduled. Boeing, however, strongly re-affirms its guidance on production of 10 a month by close of 2013.

But UBS Investment Research, in a recent client report 787 Learning Curve & Implications, concurs, forecasting Boeing will not reach 10 a month until late in 2014.

Its guidance is for 17 this year and 46 next, with 82 in 2013 and 118 in 2014. On the production line now is the first 787 for United and the third for China Southern.

A significant part of the equation on deliveries relates to the rework being done at various facilities including the Aviation Technical Services 88,250m2 facility at Paine Field, which is now being dubbed “Boeing South”.

ATS has five bays and is part of the massive job of completing well over 130,000 open tasks on 787s that clog every spare area of tarmac and concrete at Paine Field. The airport has even closed runways to accommodate 787s and 747-8s.

Boeing also moved 787 work to its Global Services & Support site in San Antonio, Texas, in March. Line number 23 – for Japan Airlines – was the first to undergo change incorporation to conform with the standards established as part of type certification efforts. The centre is handling three aircraft for airlines and three of the flight test aircraft that are not being scrapped.

Some of the work done in San Antonio includes installing electronic and mechanical equipment, completing software upgrades, testing functional systems, and removing and reworking wiring or equipment that needs to be updated to current configuration requirements.

South Carolina

Adam Pilarski, senior vice president of consultancy Avitas, raises concerns about the South Carolina 787 final assembly facility, which is due to produce three 787s a month, telling Australian Aviation it will take “considerable time to get up to speed,” and thus will increase costs on the 787.

“There’s a reason people get paid good money in Seattle. They’ve been doing it a long time,” he said. “It’s not as easy as it sounds.”

Boeing opened its 59,710m2 South Carolina assembly building on June 10 to much fanfare, with Boeing VP and GM Boeing South Carolina promising that “in this building, our talented Boeing South Carolina teammates are going to assemble the finest, most technologically advanced commercial widebody airplane in history.”

He added that “we look forward to demonstrating what ‘made with pride in South Carolina’ is all about.”

Ironically, the building that Boeing hopes will get its 787 back on track was ready six months ahead of schedule. Final assembly of the first South Carolina 787 will begin shortly.

The assembly line is now the subject of a dispute with The International Association of Machinists and the National Labor Relations Board, which both accuse Boeing of building a non-union 787 plant in South Carolina to punish the IAM for past strikes.

Boeing emphatically denies that claim, saying the jobs in South Carolina represent new employment, not the relocation of existing work – which of course is true, although documents seem to suggest that labour issues were a consideration.

But it ought to be remembered that Boeing did not choose the South Carolina site, its then partners Vought and Alenia did when they set up their joint venture Global Aeronautica.

Vought, a long time Boeing supplier, built a facility to produce the aft fuselage 7m long section 47 and the 4.6m section 48, which included the aft pressure bulkhead.

Vought’s contract for the 787 was built on a long and continuous history of structural work with Boeing, including the empennage of the 747, 757 and 767, wing centre box of the 767, engine fan cowl doors and panels for the 747, 767 and 777, doors for the 737, 747 and 767 and flight control surfaces of the 777.

The company also has extensive composite structural experience on developments such as the wings for the Northrop Grumman Global Hawk, the horizontal stabiliser and engine nacelles for the C-17, fuselage for the Bell/Boeing V-22 and the large stabilator for the Lockheed Martin F-22.

Vought partnered with Alenia to form Global Aeronautica to build an adjacent production hall for mating and stuffing of the entire fuselage, save the nose which is built by Spirit.

Alenia is building in its 64,100m2 factory in Taranto-Grottaglie Italy the 8.5m long section 44 and 9.8m section 46, and these are flown to South Carolina along with section 43 from Kawasaki and section 45/11 from Fuji Heavy Industries.

Boeing purchased Vought’s 50 per cent share in Global Aeronautica in March 2008 after the company moved to increase oversight at the North Charleston facility, and it then acquired Vought’s aft fuselage facility in July 2009.

Boeing announced the South Carolina 787 line in October 2009, and completed the acquisition of the remaining 50 per cent share of Global Aeronautica from Alenia in December of that year.

To support the South Carolina facility, Boeing opened a 3250m2 vertical fin composite assembly line at its facility in Salt Lake City, Utah, on June 28. Operated by Boeing Fabrication, the site will build the vertical fin assemblies for the 787s built at Boeing South Carolina.

Boeing’s Salt Lake City facility supports fabrication activities across all Boeing’s commercial models. It is scheduled to deliver its first vertical fin to Boeing South Carolina during the fourth quarter of 2011.

Progress

There is, however, no doubt that Boeing and its partners have made significant progress in refining the production process of the 787 with far less clutter surrounding the aircraft on the production line.

Australian Aviation has visited the Everett facility numerous times over the past two years and the progress is undeniable.

Boeing vice president 787 systems Mike Sinnett told Australian Aviation in September that the travelled work situation had improved dramatically.

“For the aircraft that are coming in right now, they’re coming in a very good condition and our final assembly and delivery is able to move those airplanes through,” Sinnett said, explaining that Boeing is now finishing 787s on the line and the wing to body join rework is completed.

However, Boeing director of final assembly Larry Coughlin conceded to the Seattle Times it’s not where it needs to be. “It’s not all perfect yet. It’s getting better,” he said.

There is also a positive buzz on the factory floor and in the offices that overlook the production hall.

Over the past two years Boeing has been moving engineering and administration offices to both its Everett and Renton production halls to better connect its engineers and support staff with the production process.

One of those offices is the Production Integration Center, which it set up in December 2008 as mission control headquarters for the 787 global supply chain. The facility monitors in real time second by second changes at suppliers from the lowest to highest tiers and the impact any glitches might have. Not one part of the 787 moves – or doesn’t move – without the PIC knowing.

And parts are now underway for the 787-9, which is 6m longer than the -8, after a critical design review in September, according to Sinnett. To achieve the 6m stretch, the forward section 43 built by Kawasaki and the after section 46 built by Alenia are each being increased in length by 3m. Mandrels and jigs are being installed for the longer barrels.

The 787-9 will carry about 40 more passengers than the -8 and fly to a range of 8,500nm.

To accommodate the additional takeoff weight, which climbs 22,680kg to 250,835kg, the wing, fuselage and empennage skins will be of a heavier gauge, while the landing gear is being beefed up.

It is not clear what line number will be the first 787-9, but a general consensus is 139.

There is also general consensus that Boeing has set itself an aggressive target for the 787 learning curve to achieve program profitability.

Bernstein Research said in an August 16 client report Boeing: A Profitable 787? It Depends on the Time Horizon – A Detailed Assessment of Potential scenarios, that “it appears unlikely to us that Boeing will deliver a positive gross margin over an initial accounting block of 1,000 airplanes.”

However, balancing that assessment, Bernstein noted that there are numerous factors at play and Boeing is more optimistic in its assumptions.

The manufacturer insists to Australian Aviation that it is not looking at a loss on the first 1,000 787s. At the ANA handover McNerney said that the program would be cash positive before 2020.

In detail, Bernstein claimed that when the 787 program was launched, pricing was set at a level that did not adequately reflect the aircraft’s costs.

“Then, to make matters worse, the program was extraordinarily successful, with more than 800 orders that locked in pricing through 2018. The distributed supply chain has also made cost reduction more challenging than on prior programs, with uneven levels of performance by different suppliers.”

Adding to the challenge, Bernstein says, has been the need to compensate customers for delays and address assertions by suppliers that have been negatively impacted by design changes and delays.

“Boeing management has said that it has been successful at both increasing price and reducing cost. Price increases have been through conversion of 787-8 orders to 787‑9s, as well as through renegotiating price as slots are adjusted,” Bernstein said.

Interestingly, according to Bernstein the program is in the unusual position of actually benefiting from order cancellations, because it may be able to raise prices on new orders.

“Still, input we have received regarding pricing suggests that the pricing upside is limited. We understand that at least half of the 787-8 orders have options to move to a 787-9, which fixes the pricing upside. Furthermore, some 787-9 ‘upgrades’ are being used as a means of compensating airlines with 787-8 orders for delays (ie no added pricing).”

There are of course many cost reduction programs under way, such as redesigning the horizontal stabiliser and bringing it in-house from Finmeccanica on the 787-9.

And Bernstein is upbeat on the long term success of the 787.

“Despite what we see as a high degree of difficulty in avoiding a forward loss on the 787, the situation has a positive side. Assuming our base cost estimate, with US$120 million pricing and an 82.5 per cent learning curve, unit number 1000 should have an 18.7 per cent gross margin, which starts to approach current 777 margins which we estimate at about 22 per cent. This means that despite a tough initial period for the 787, this program could deliver profitability comparable to other programs.”

Bernstein’s base calculations are done from aircraft number 45.

Learning curve

The learning curve was introduced to the aircraft industry in 1936 when T P Wright published an article in the February 1936 Journal of the Aeronautical Science. Wright described a basic theory for obtaining cost estimates based on repetitive production of aircraft assemblies. The theory of learning recognises that the direct labour man-hours necessary to complete a unit of production will decrease by a constant percentage each time the production quantity is doubled.

If a given unit build takes 1,000 man hours the second will take 800 man hours – which is 80 per cent of the first, and the third will take 640 hours, being 80 per cent of the second – showing a 20 per cent reduction in man-hours every time production is doubled.

UBS’s June client report 787 Learning Curve & Implications claims that Boeing is planning for a faster learning curve on the 787 than it achieved “on the 777 despite having less control of production”. Boeing achieved a 16 per cent learning curve on the 777, which is consistent with NASA historical guidance for 15 per cent learning on typical aerospace programs.

UBS says that Boeing’s assumed learning curve is a key component of its forecast for 787 profitability and cash generation.

“With 777 type learning, we estimate Boeing would likely be in a forward loss with flat to progressively worse 787 cash flow over the next several years,” UBS said.

VIDEO: A look the flight of a Boeing 787 to Japan for a visit with launch customer All Nippon Airways in 2011 from the Boeing YouTube channel.

Boeing has disclosed, says UBS, “that it sees its 787 unit production cost approaching its average program accounting cost as it hits a rate of 10 a month, implying early 2014.”

UBS says that given Boeing’s assumption for zero margins on its initial program accounting quantity (block), this implies an expectation for a per unit cost in line with its average selling price by 2014.

“Our analysis indicates that in order for Boeing to do this, it must bring its 787 manufacturing cost down roughly 50 per cent faster than it did on 777. Specifically, we estimate Boeing’s unit cost would need to drop from US$250-300 million currently to US$113 million (our assumed average cost and price), with its cumulative average cost dropping at a 24 per cent rate with each doubling in production (learning curve).”

Boeing is yet to announce the size of its 787 accounting block, but analysts assume a 1,000 to 1,100 unit figure.

The research group adds that “if Boeing were to instead learn like it did on 777, we estimate that its average unit cost will only drop to US$150 million by 2014 with an extremely large block required for it to not be in a forward loss”.

Putting that analysis in perspective, Boeing has written off the first three 787 test aircraft at a cost of US$2.5 billion, which implies an average build cost of more than US$800 million each.

UBS adds that under a 777 type learning, it sees the 787 burning US$4 billion in cash on average annually through 2015.

Whichever the scenario, the 787, which started out as a $5.8 billion development program in 2004, has ended up as the ultimate in sporty games. At Boeing’s annual investor conference in May, McNerney conceded that the missteps on the 787 have cost Boeing “billions upon billions” in additional development dollars.

Engines

The Rolls-Royce Trent 1000 powered 787-8 received its type certification on August 26 from the FAA and EASA, although only for the package A model of the engine.

The British engine maker’s package B engine has been in flight test since May on ship ZA004 and was due to be certified in October.

At the core of the improvement package, which is expected to get the Rolls-Royce powered 787 to within one per cent of its guarantees, is a revised six-stage low-pressure turbine design, and relocation of the intermediate pressure compressor bleed offtake ports and fan outlet guide vanes and high aspect ratio blades.

Beyond that Package B, Rolls-Royce has a Package C aerodynamic upgrade which will run in 2012 and is for the 787-9. However, the Package C options will also be incorporated into the 787-8 Trent 1000 engines.

Arch rival General Electric has also been striving to get its GEnx-1B engine close to specification, with PIP1 and PIP2 upgrades from the baseline Block 4 standard either certified or in the works. In fact, due to the delays in the program the baseline and PIP1 engines are in flight test together. It is expected that Japan Airlines’ first 787 to be delivered this month will be powered by PIP1 GEnx-1B engines. The airline is the launch customer for the GEnx engine.

First Delivery

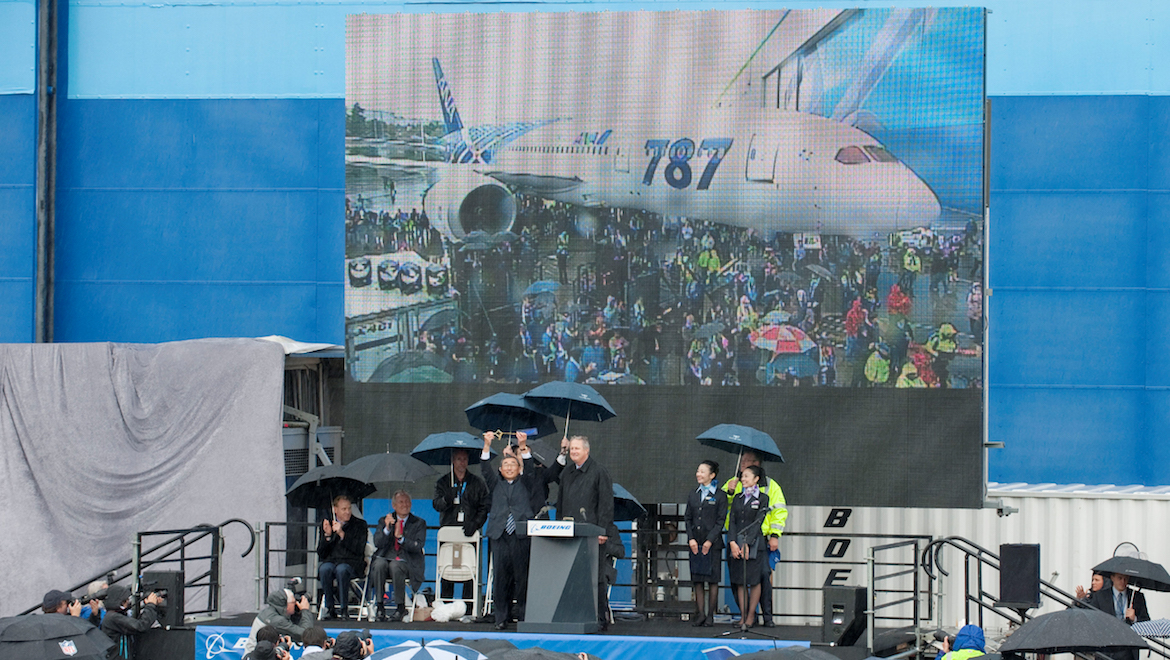

On September 26 all the challenges ahead were forgotten as Boeing celebrated with launch customer All Nippon Airways the delivery of the first 787 in a ceremony adjacent to the factory where the aircraft is assembled. More than 500 employees representing the 787 program walked in the rain alongside the specially painted 787 to present it to ANA executives as a crowd of thousands looked on.

“Today we celebrate a significant moment in the history of flight,” McNerney said.

“The 787 is the biggest innovation in commercial aviation since the Boeing 707 introduced the world to passenger jet travel more than 50 years ago. I want to thank ANA and all the employees of Boeing and our partner companies for the talent, technology and teamwork that have brought this game changing airplane to life.”

During the ceremony, Albaugh presented a ceremonial key to Shinichiro Ito, president and chief executive of ANA.

“It’s not often that we have the chance to make history, do something big and bold that will change the world in untold ways and endure long after we are gone,” Albaugh said.

“That’s what the 787 Dreamliner is and what ANA and Boeing have done together – build what truly is the first new airplane of the 21st century.

“We are delighted to be taking delivery finally of our first 787. ANA is extremely proud to be the launch customer for the Dreamliner and to have helped Boeing so closely in the development of this state-of-the-art aircraft,” said Ito.

“The Dreamliner will enable us to offer unrivaled standards of service and comfort to our passengers and will play a key part in ANA’s plans for international expansion.”

Ito added that he “cannot wait till the skies are filled with 787s”.

By the end of ANA’s fiscal year ending March 31 2012, the airline expects to have 12 787s in service and will have another eight in the following fiscal year. ANA has orders for 55 787s, of which 15 will be the -9 variant.

ANA’s 787-8s for domestic and short haul routes seats 12 business and 252 economy seats.

Its arch rival Japan Airlines has ordered 35 787-8s.

Boeing Commercial Airplanes vice president and general manager airplane programs Pat Shanahan possibly put the entire program history into context when he said: “Today you join the ranks of the legends of our industry. I have no doubt that 30 or 40 years from now another outstanding Boeing team will be celebrating a new version of the 787. They will struggle to find the words to express their deep respect and admiration for the hard work you have done in getting us to this day and laying the foundation for a strong future for Boeing and for our industry.”

And that strong future, suggests chairman of United Continental Holdings Inc Jeff Smisek, is all about the 787’s capabilities.

“It’s a spectacular and game changing aircraft.”

VIDEO: A look at the official delivery ceremony of All Nippon Airways’ first 787 from the Boeing YouTube channel.

This story first appeared in the November 2011 edition of Australian Aviation. To read more stories like this, subscribe here.

RHeaton

says:Ditching the 737 Max and focusing on production of the 787 would be a smart move for Boeing, but i think ego wont let that happen.