To mark the first flight of Virgin Blue on August 31 2000, this story from the Australian Aviation archives is from September 2010, when Ellis Taylor looked at the first decade of of the airline’s operations.

August 31 2010 was a major milestone for Virgin Blue, with the airline celebrating its 10th anniversary – a feat that at some stages appeared unlikely.

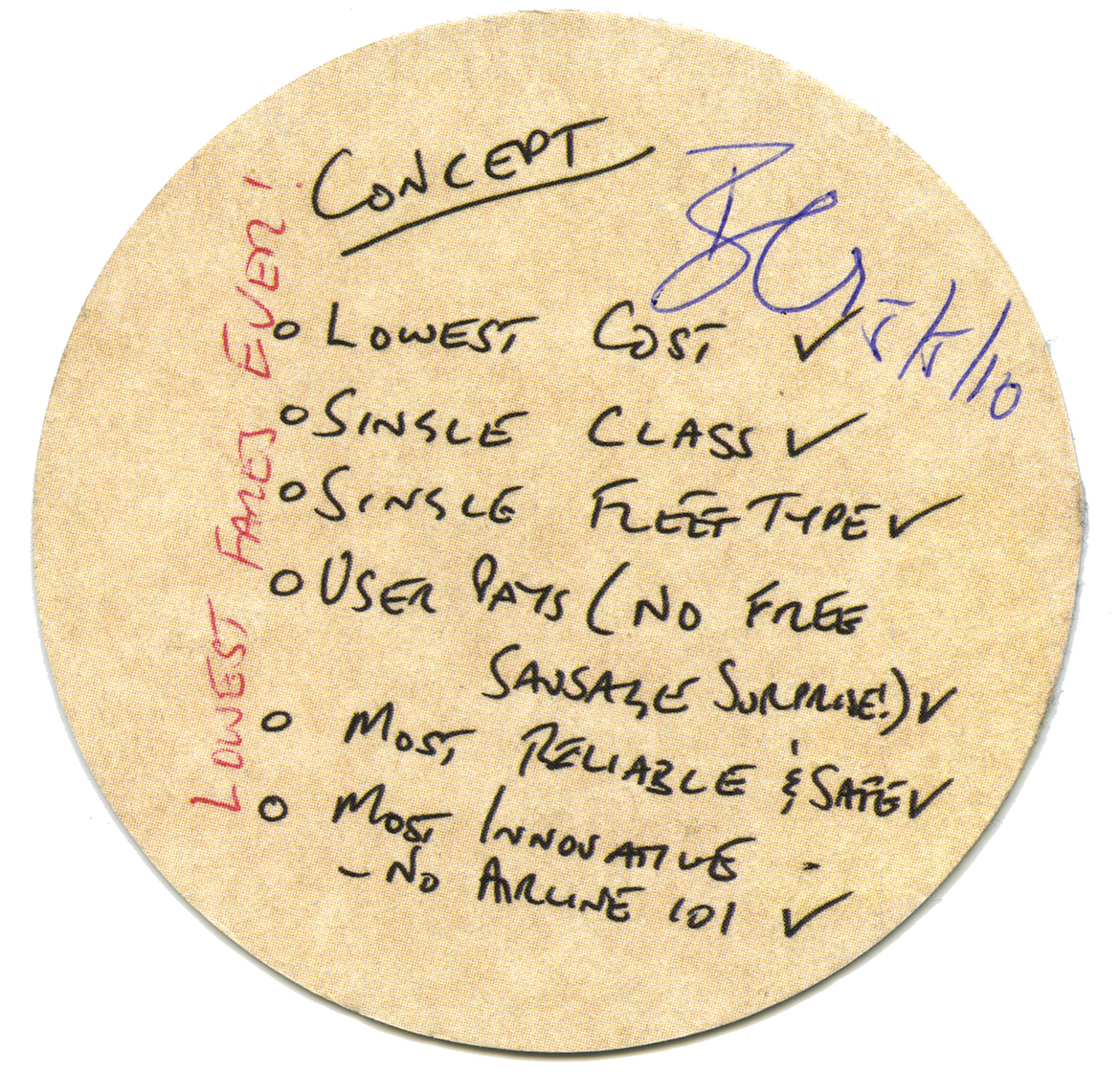

For an airline which famously started off as a concept nutted out on beer coasters in a London pub during the 1993 Ashes Test series by Virgin Atlantic junior finance manager Brett Godfrey and good mate Rob Sherrard, the Virgin Blue group has now grown into one of the leading carriers in the Australia-Pacific region, operating across a number of markets and reshaping the industry as it has been reshaping itself.

Some years later after Godfrey refined and successfully pitched his business plan to Sir Richard Branson, on November 30 1999 Branson’s Virgin Group announced that it would establish a low-cost carrier in Australia. Godfrey’s research had shown that Australian airfares under the Qantas-Ansett duopoly were about 40-50 per cent higher than comparable fares in Europe, and was ripe for a new airline to enter, despite the two previous failed Compass attempts.

While the concept was enthusiastically welcomed by the travelling public, a number of industry observers still had reservations. Those reservations heightened when soon after the Virgin announcement, regional airline Impulse Airlines revealed its own plans to operate low-cost services on the Melbourne-Sydney-Brisbane triangle using new Boeing 717s, starting in June 2000.

The news was a massive blow for the Godfrey-led management of the fledgling airline, and almost caused Virgin to reconsider its plans.

“They were really upset and devastated, almost to the point of giving up when they heard that Impulse were coming into the market,” Centre for Asia Pacific Aviation chairman Peter Harbison told Australian Aviation.

“They figured, probably rightly, that there wasn’t room for four carriers in the marketplace that weren’t fully established.

“At the time, we felt that it was fairly precarious,” he added. “Not that it was unlikely to succeed, but it was obviously a challenging position to be in.”

Nevertheless, Virgin went ahead and in May announced that it would be called Virgin Blue, in reference to the “bluey” nickname given to redheads. It nominated August 3 as the starting date for its services, initially operating seven daily services between Brisbane and Sydney utilising two Boeing 737-400s. However, a delay in gaining its air operator’s certificate saw its first service slip to August 31, forcing it to refund a number of tickets.

The style of service offered by Virgin Blue was indicative of the Virgin brand itself, which was largely cheap and cheerful. With the airline a dedicated low-cost carrier, no inflight entertainment was offered except for that put on by the cabin crew, including a number who were trained in face painting. Similarly, passengers soon grew used to a new concept – paying for meals and booking online or through call centres.

The launch of Virgin Blue immediately led to an unprecedented fare war. While Branson had vowed that Virgin Blue would sell half of its domestic seats at $99, Impulse undercut it by offering $33 fares. Similarly, Qantas and Ansett also undertook a serious discounting war, with the four competitors often accusing each other of dumping seats on certain markets.

The vicious competition came at a time of a falling Australian dollar (which fell below US50 cents) and rising fuel costs. It was an incredibly tough environment for all four carriers and something needed to give. Soon after, the industry took its first turn as Impulse became the first carrier to show its hand.

In April 2001, Impulse CEO Gerry McGowan announced that the airline would cease its services and instead fly under contract for Qantas after it failed to secure extra funding from its shareholders. Within months, the carrier was taken over by Qantas and relegated to flying on regional routes under the QantasLink banner, while Qantas and Ansett turned their attentions to countering the threat that Virgin Blue still posed, particularly as it had started spreading its network and adding to its fleet.

But Virgin Blue was far from immune to the falling dollar and rising fuel costs, and had not benefitted from the Sydney Olympics, which had in fact seen domestic traffic fall considerably.

Indications are that this had a major impact on the airline, and it is rumoured that Branson was close to selling the carrier to Air New Zealand-Ansett, although the latter was not willing to pay the price that Branson wanted for the fledgling leisure carrier.

On September 4 2001, Branson called a press conference where he revealed that the airline had been approached with a takeover offer by the Kiwi carrier. In a typically bold Branson gesture, he ripped up a cheque representing the proposed takeover.

“Australians have benefited dramatically since Virgin Blue cut airfares in half over 12 months ago. Although we could have walked away with a $250 million net profit on our investment, I felt it would be selling out both the Australian public and our staff,” he said. “Instead, we will invest many millions more in expanding our fleet and flying new routes.”

While at the time it was seen as a cheap stunt, it turned out to be a pivotal point in the Australian market, as only a few days later Ansett entered voluntary administration. A few months later, despite an attempt to restart the carrier, Ansett joined the fate of the two Compass airlines before it.

Purple patch

The collapse of Ansett was a defining moment for Virgin Blue, which as the only other carrier against Qantas, was presented with an opportunity which would have been the envy of every other airline in the world, particularly in a post September 11 environment.

“Where they were extraordinarily fortunate was that it coincided with September 11. As a result of that, there were a lot of crew, staff and aircraft available,” said Harbison.

With the opportunity to grab a larger slice of the market, Virgin set about making the most of the unique opportunity and set out plans to lease some of the former Ansett aircraft, although this effort was largely frustrated. It also embarked on a plan to go after Ansett’s former terminals around the country in order to allow it to grow into the second major carrier and fend off the growth that Qantas was quickly undertaking.

“We got presented with a unique opportunity when Ansett fell over,” Godfrey said in 2004. “We looked long and hard, do we just continue with a marginal growth plan or do we throw caution to the wind and go and be the second carrier in this country?”

To make that leap required more money, which came through Patrick Corporation paying $260 million for a 50 per cent stake, helping to capitalise the airline which until that point had relied upon $10 million of seed capital and a further $15 million loan from the Virgin Group.

The new investment allowed Virgin to go after new aircraft, and in January 2003 it announced that it had reached an agreement with Boeing for an order of up to 50 737NGs following an assessment against the Airbus A320. As Qantas had done months before it, the airline was able to use the prevailing conditions to its advantage in its negotiations with Boeing.

“We did the first deal post September 11 that was of any substance with Boeing, and as a result of that situation there were suddenly a number of white tails being produced without owners so we got 50 options at prices that will never be repeated,” Godfrey told Australian Aviation in 2004.

The first deliveries from the order started in August 2003, which Virgin Blue said was intended to set it up for growth over the next 10 years. In time, the carrier would eventually exercise all of those options as well as order additional 737s, which became the backbone of its fleet as it expanded its network nationwide.

As Harbison noted, the years immediately following Ansett’s collapse would turn out to be the brightest purple patch for the airline. “2001 to 2004 was the perfect period to enter the market as a low-cost carrier. Aircraft prices were low, fuel prices were low, there were no skills shortages and most of the incumbents were fat and incapable of defending themselves.”

By 2003 the airline had grown into an enviable position. From two aircraft and one route at launch two years prior, it had grown to 40 aircraft operating on 37 routes, and had managed to capture more than 28 per cent of the domestic market. The airline was also a financial success, posting a threefold increase in profit for the year to March 31 2003 to $158 million as revenue soared by 136 per cent to $924.3 million.

Into that background the airline launched an initial public offering, with the December 2003 listing on the ASX helping raise $400 million and allowing the Virgin Group to make a tidy profit on its initial $10 million investment.

As well as growing its domestic network, the airline announced its first international foray, with plans to launch flights from the east coast to the Pacific Islands and New Zealand. This became possible through the public listing, which effectively made Virgin Blue a majority Australian-owned airline.

However, as always there were challenges. The largest was an agreement between the Virgin Group and Singapore Airlines which effectively vetoed the use of the Virgin name outside Australia. As a result, the airline established Pacific Blue, based in New Zealand, allowing it to access lower cost labour in New Zealand.

Initially, it operated on services between Brisbane and Christchurch in 2004, gradually adding a number of other trans-Tasman services, and later in 2007 entered the domestic New Zealand market.

It then entered into a partnership with the Samoan government during 2005 to start Polynesian Blue, which operates flights to and from Apia using Pacific Blue aircraft.

While the airline continued to perform well, there was some concern from shareholders, particularly with Qantas’s move to establish Jetstar in 2004.

Qantas CEO Geoff Dixon claimed that Jetstar would be “the lowest cost airline in Australia by some distance,” thanks in part to the resources of its parent, which had unsuccessfully tried a number of moves to combat the growth of Virgin Blue.

Into a new world

With the reshaping of the market, it became clear to some Virgin Blue shareholders that a change of tack was required to ensure that it didn’t get locked into a race to the bottom with Jetstar. However, major shareholders Patrick and Virgin couldn’t agree on a clear way forward for the carrier.

In this climate, in 2005 Patrick Corporation launched a takeover bid for the airline. Although the board of Virgin Blue recommended that the offer be rejected, Patrick ended up with a controlling 62.4 per cent stake. Following a major falling out with Patrick, the Virgin Group retained its 24.5 per cent stake.

Harbison said that the persistence of Branson has created some difficulties for the airline. “He has actually made life very difficult for Virgin Blue by probably failing to deliver in terms of improving its capital, by having essentially a veto power in many cases and generally a reluctance to depart from the Virgin mould.”

Nevertheless, following the takeover Godfrey announced that the carrier was changing strategy to become a “new world carrier”.

“Instead of being static, Virgin Blue has recognised the opportunity to develop the low-cost carrier model into a new type of network carrier, one that gains the maximum yield available whilst still providing exceptional service at low cost,” the airline said in its 2006 annual report.

Under the new strategy, the airline placed its focus firmly on making inroads to the higher yielding corporate travel market, which had been dominated by Qantas since the demise of Ansett. This would be achieved by selectively offering a range of new products, such as premium economy, seatback live TV, a loyalty program and a range of pay-for-use lounges in terminals.

The new strategy was both inspired and also risky. If it worked, the carrier would be able to move out from the leisure market and steal some marketshare from Qantas, while also being risky because it could be caught in a no-man’s land, as Godfrey noted in a 2004 interview. “I’ll never want to be the guy in the middle because it means you’re neither here nor there,” he said.

But, as Harbison noted, the middle appeared to be the better opportunity rather than remain caught in a race to the bottom against Jetstar. “They were starting to hit the ceiling, particularly on the low hanging fruit, so really expanding at the low priced end of the market, particularly as Jetstar was really tracking it very, very carefully, was really going to leave them stagnating in the future,” he said.

One of the biggest changes to come about was the order in November 2006 for 11 Embraer E-190s and three E-170s, with deliveries starting from 2007. The 70-seat E-170s were particularly to go head-to-head with QantasLink on key routes, such as Sydney-Canberra, while the E-190s offered a down-gauging option to fit under the 144-seat 737-700s. The airline soon exercised options on a further six E-Jets, taking the number of E-170s to six and E-190s to 14.

Virgin Blue began branching out to establish interline and codeshare arrangements with carriers such as Emirates, South African Airways and United Airlines, which helped to grow revenue and passenger volumes.

Despite the move to focus on higher yielding traffic, the takeover of Patrick Corporation by Toll Holdings meant that Virgin Blue was once again under a new major shareholder. Toll CEO Paul Little had indicated initially that he would seek to sell the Virgin Blue stake as it wasn’t considered core to its business, with Branson indicating that he would be interested in buying back control of the airline.

However, after failing to find a buyer for the airline, Toll announced in July 2008 that it was selling down its stake through an in specie dividend to its shareholders. This effectively saw it gift the shares to Toll’s shareholders, and resulted in the Virgin Group once again becoming the largest shareholder.

Long Hauls and downturns

In the last few years, the high-performing airline has been grappling with new challenges in the long-haul arena as well as the worst conditions in aviation history.

Moving into long-haul services was long a vision of Godfrey’s, and in 2007 Virgin announced that Virgin Blue would launch a new airline focused on the trans-Pacific market. Unlike Virgin Blue, the new airline would offer a three-class service (economy, premium economy and business class), but its cost structures would be much lower than incumbents Qantas and United Airlines, allowing it to offer lower fares.

To operate the services, Virgin placed an order in March 2007 for six 777-300ERs and six options, while it would also lease one aircraft from ILFC. Given the name V Australia in May that year, the airline was set to launch in December 2008, initially on the Sydney-Los Angeles route, while later adding services from Brisbane and Melbourne.

However, a strike by Boeing machinists which shut down the factory in Seattle forced V Australia’s launch date back to February 2009, resulting in the airline having to rebook a number of passengers on its competitors’ flights or offer refunds. It also put its launch squarely in the middle of the downturn from the global financial crisis, and Delta Air Lines had announced that it would become the fourth competitor on the Sydney-Los Angeles route with its services to start in June 2009.

“Having to delay the 777 to after Christmas having sold all of those seats was what they didn’t need, not to mention having the world’s biggest airline suddenly up against you and something of a rather large downturn,” commented Harbison.

In response to the massive changes on the Pacific, V Australia was forced to make some tactical changes. While it maintained a daily Sydney-Los Angeles service, the airline cut back its plans from three to two times weekly from Melbourne, and instead launched services to Phuket and Nadi, and also Johannesburg during 2009.

“We were starting off on a very ferocious front in terms of the trans-Pacific, so we said let’s look at some other markets that will be long and fluid and not require daily services,” Godfrey told Australian Aviation in late 2009.

However, some relief came in July 2009 when Virgin Blue and Delta announced that they were planning a wide-ranging joint venture on Australia-US routes, which would help to remove some of the competitive pressures on V Australia and open up new opportunities. While the joint venture has received approval from Australian competition authorities, at the time of writing it was awaiting a similar sign-off from the US.

While V Australia was proving something of a basketcase, short-haul markets were also feeling the pinch of falling yields as the business market softened. As a result, during 2008 and 2009 Virgin Blue cut capacity by reducing its fleet utilisation, while it also deferred deliveries on six E-190s.

The airline group also reallocated capacity to Pacific Blue, resulting in it launching new services in the Pacific, and to Asia for the first time, to Denpasar from Perth, Brisbane, Sydney and Adelaide. It also launched a nonstop Perth-Phuket service in November last year.

The entry of Tiger Airways in 2007 into the domestic market was another blow to Virgin Blue. While Tiger competed primarily with Jetstar on a handful of routes, the overall effect of the additional competition was to lower fares, putting further strain on Virgin Blue.

The major startup costs and operating loss of V Australia in its first year, as well as the domestic impact of the global financial crisis, saw it record a net loss of $160 million for the 2009 financial year. It was also forced to undertake an equity raising in July 2009, giving it $231.4 million to strengthen its balance sheet. This came after the airline had already concluded a number of sale and leaseback transactions on its fleet to free up more cash.

Change at the top

Despite him often talking of his love for the job, Godfrey announced in 2009 that he would step down by the end of 2010. As a result, the board of the airline announced in March that former Qantas executive general manager John Borghetti would succeed Godfrey from May 8.

Borghetti’s appointment was welcomed by a number of analysts who saw that his background at Qantas would allow the airline to make further inroads to the lucrative corporate and government travel market.

However, the airline has not yet been able to escape the poor conditions in some of its core markets, with the airline’s net profit this year expected to only come in at $20-$40 million, compared to earlier guidance of $80 million. The company noted that there was a “rapid deterioration and increased volatility in the operating environment, particularly in respect of the leisure segment both domestically and internationally,” adding that average fares had decreased by 10 per cent.

Harbison said that to reverse this decline, the airline will have to take its focus away from the leisure market and make some tough decisions. “Clearly the signal is that they’re going to go after yields. To do that they’re going to have to spend quite a lot of money first, and that’s the difficult bit.”

Some changes have already started, with Borghetti initiating a major restructuring of the company’s management. A number of former Qantas executives have been hired to run functions such as pricing, government relations and sales, while a number of Godfrey’s executive team have been shown the door. The airline has also started to integrate V Australia’s management into that of Virgin Blue, meaning that it will no longer be operated as a separate company.

Virgin Blue appears set to launch a dedicated business class on its short-haul services, replacing the premium economy which Borghetti has labelled as “marginally successful”.

New widebodies are also rumoured to be on the way, with some media reports claiming that the airline is looking to lease A330-200s from Emirates as a short term solution ahead of a possible order for Boeing 787s. The aircraft would be used to provide domestic widebody capacity as well as take over from the 777s on routes like Phuket.

One of the great hopes for the airline is an alliance with Air New Zealand on trans-Tasman routes, which was awaiting regulatory approval as of early August. Both partners have been quick to point out that the proposed alliance would only operate on the Tasman, while Air New Zealand has also recently been forced to deny reports that it is planning to buy a cornerstone stake in Virgin Blue.

Harbison said that the alliance could be a major positive for Virgin Blue. “If that is extrapolated upon, if Air New Zealand as a next step becomes a virtual domestic operator within Australia, there are some tremendous synergies there. It’s a matter of John Borghetti and (Air NZ CEO) Rob Fyfe working out how they can do it, because there’s going to be some bold decisions that have to be made.”

Another change expected at the time of writing is a new name for the airline group which would be applied across its operations, something which Godfrey pointed to during his late 2009 interview with Australian Aviation. However, indications are that a dispute with the Virgin Group may delay the renaming for some months.

From where it started, Virgin Blue has come a long way over the past 10 years, changing the face of the local airline industry while also being forced to make some major changes itself. With some big projects ahead of it, just where the carrier will be after the next 10 years looks to be far removed from its humble beginnings.

VIDEO: Highlights from Virgin Blue’s 10th birthday celebrations from the wheregreatideasfly YouTube channel.

This story first appeared in the September 2010 edition of Australian Aviaton. To read more stories like this, subscribe here.

RHeaton

says:Great coverage of this airline…. you can see how far its come….. and how much JB wreaked havoc on the finances of VA.

I kind of wish AirNZ bought out VA, that way it would have been run properly! Especially after a serious 350m loos announcment!

Really, better to have a single fleet, but thats not nessasary if you have Boeing and Airbus, like VA and Tigerair….. you just got to expand them so that you get scale and discounts for the scale. Clearly something JB and VA management know nothing about.

Dan

says:Problem with an Air NZ takeover is that many Aussies remember what happened to Ansett courtesy of Air NZ and their “own version of John Borghetti” at the time (aka Selwyn Cushing). But VA/NZ ended up being moot when the other shareholders voted against Luxon to oust JB.

Cushing and NZ took over an ailing AN despite knowing his company didn’t have the financial resources to fix a problematic AN (which was started all the way back when TNT and Abeles took over AN in the 80s).

Steven Sarow

says:What a great story. I have worked for Virgin Blue, Virgin Australia for over 18 years and I had forgotten some of those pivotal times… thanks for the trip down memory lane. Let’s hope we continue to create more memorable times in the Australian Skies..