Air New Zealand chairman Tony Carter says rising fuel prices represented the airline’s greatest challenge for the year ahead.

Speaking at the airline’s annual general meeting in Christchurch on Wednesday, Carter said the company was optimistic about the current market dynamics and demand trends.

However, he said the current levels of jet fuel price would be a “headwind on profitability compared to the prior year”.

At its 2017/18 full year results announcement in August, Air New Zealand had guided the market to expect underlying earnings before taxation in the vicinity of NZ$425 million to NZ$525 million for the 12 months to June 30 2019.

This excluded an expected NZ$30 million to NZ$40 million impact from the schedule changes due to the Rolls-Royce Trent 1000 engine issues that power Air New Zealand’s Boeing 787-9 fleet.

While the earnings guidance was unchanged at Wednesday’s annual general meeting, Carter said the outlook statement assumed an average jet fuel price of US$85 per barrel, while noting jet fuel prices had recently been “trading above this level”.

“Fuel is certainly the biggest headwind we face, undoubtedly,” Carter said in response to a shareholder question.

A recent report from the International Air Transport Association (IATA) noted jet fuel prices were at just under US$90 a barrel.

And while jet fuel prices eased slightly in August, the IATA financial monitor report said the upward trend remained in place.

“The key drivers of the upwards trend in oil and jet fuel prices since early 2017 are the gradual reduction in oil inventories, as well as various geopolitical tensions and uncertainties,” the IATA report said.

“In recent months, the stronger US$, geopolitical stability and an announced supply increase by Saudi Arabia has brought some respite in the price up-trend.”

Air New Zealand reported net profit after tax of NZ$390 million for 2017/18, with earnings before taxation of NZ$540 million.

On the 787-9 engine issues, Air New Zealand has dry leased one EVA 777 and two Singapore Airlines 777s as cover for its out-of-service 787-9s and made some schedule changes in order to free up aircraft to maintain some form of schedule reliability.

Luxon said Air New Zealand has had to cope with having up to five of its 13 787-9s not flying while engine inspections were carried out in Singapore.

“We could expect anywhere from three to five of our 13 Dreamliners to be on the ground at any one point in time,” Luxon said.

“Some weeks it is one to two, some weeks it is zero, at worst case it can get up to five so we’ve got to build in that fat and that cover to be able to deal with that going forward.”

Luxon said it was a very frustrating time dealing with the operational challenges as a consequence of the 787-9 Rolls-Royce engines needing more maintenance and servicing checks due to durability issues on some components.

Air New Zealand capacity guidance also unchanged

The airline has also reaffirmed previous capacity guidance of four to six per cent growth across the domestic and international network for the current financial year.

Broken down further, domestic capacity was expected to grow by three to five per cent amid good offshore demand for travel within New Zealand and strong business traffic.

The trans-Tasman and Pacific Islands network will have the largest growth at seven to nine per cent.

This was due to the introduction of the Airbus A321neo from November 12, as well as new routes between Australia and New Zealand following the end of Air New Zealand’s alliance with Virgin Australia at the end of October.

The A321neo, to be powered by Pratt and Whitney engines, will be configured with 214 seats in a single-class configuration, compared with 168 seats on the current A320ceos operating on trans-Tasman and Pacific Islands services.

Finally, international long-haul services will grow by three to five per cent, with Auckland-Chicago and Auckland-Taipei due to launch in the period ahead alongside extra flights to Singapore.

“I am very optimistic about the market dynamics across our key markets,” Air New Zealand Christopher Luxon said in his prepared remarks to the annual general meeting.

“The competitive environment has stabilised and more importantly, underlying demand is looking very robust.

“From a macroeconomic perspective, we see continued strength in the New Zealand economy, despite some of the commentary in the media, and we believe this supports both domestic and outbound travel.”

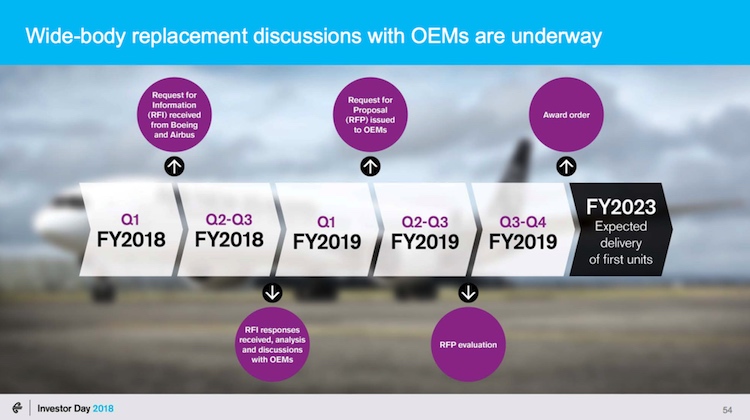

Widebody order on track for 2019

Luxon said Air New Zealand was continuing to evaluate a replacement for its eight Boeing 777-200ER widebodies.

“Work is being done now to assess what aircraft will be most suited to our future network, and we will be announcing the result sometime in the first half of calendar 2019,” Luxon said.

Currently, Air New Zealand has eight 777-200ERs that are configured with 312 seats, comprising 26 in business in a 1-2-1 layout with direct aisle access for every passenger, 40 in premium economy at eight abreast and 246 in economy at 10 across.

The aircraft, which are mainly used on long-haul services to the Americas and Asia, as well as select trans-Tasman and Pacific Islands routes, were delivered between 2006 and 2007, making them between 11 and 12 years of age.

Candidates to replace the 777-200ER comprised the 787 family and the 777-X family from Boeing, as well as the Airbus A350 family.

Air New Zealand chief financial officer Jeff McDowall said recently there were “no bad choices”.

Further, the airline was also working on having an aircraft capable of ultra long haul nonstop flights from Auckland to New York and other points in the Americas.

As part of the renewal of the 777-200ER fleet, Air New Zealand was also developing a new business class seat and introducing more digital technology to improve the passenger experience.

The airline was also using the fleet renewal program to design a new uniform for cabin crew, airport staff and, eventually, pilots and ground staff.

“The new uniform, which is expected to roll out in 2021 will mark an exciting new phase for the Air New Zealand brand, preceding the arrival of the airline’s new long-haul aircraft fleet and new onboard product around 2023,” Air New Zealand said in a statement.

“A review of the Air New Zealand pilot uniform will commence after the cabin crew and ground staff uniform process is completed.”

Stephen Boyce

says:Can the Rolls engines be taken off and GE engines put on instead?

Kieran

says:No, they cannot without a wing reconfigure .