Boeing has revised upwards its market forecast for aircraft deliveries over the next 20 years, with the rise of low-cost carriers, the Chinese market and global economic growth fuelling demand for passenger travel and cargo volumes.

The Boeing Current Market Outlook (CMO) for 2015-2034, published on Friday (Australian time), said 38,050 aircraft would be delivered over the next two decades, with 58 per cent to be used for growth and the remainder as replacement of older airframes. The forecast represented US$5.6 trillion worth of aircraft at list prices.

The latest CMO is up 3.5 per cent compared with Boeing’s previous market outlook published a year ago, which tipped 36,770 new aircraft deliveries in the two decades to 2033.

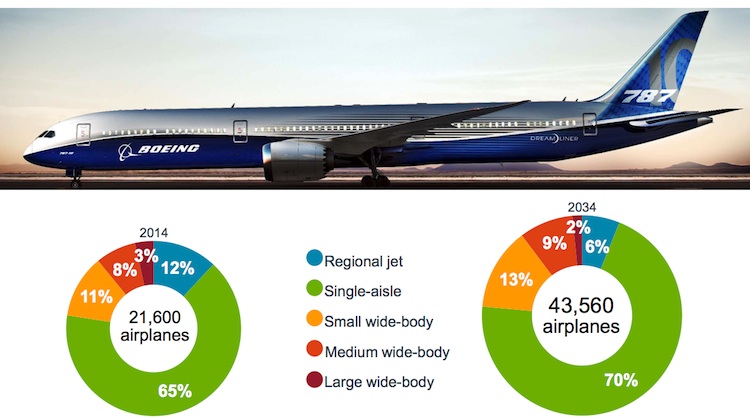

There were upward revisions were for the single-aisle, small widebody (200-300 seats) and medium widebody (300 to 400 seats) segments, while the regional jet forecast was unchanged.

“Those single-aisle airplanes that are the foundation of the networks of the airlines around the world have performed better than we’d anticipated,” Boeing Commercial Airplanes vice president of marketing Randy Tinseth told reporters during a conference call discussing the CMO on Friday.

“Frankly I don’t think we’ve fully understood and comprehended the real strength of those airlines in the emerging developing economies as well as the strength and the growth potential of low-cost carriers.”

The CMO noted the single-aisle market continued to be the fastest-growing, largest overall segment, requiring 26,730 aircraft over the coming two decades. Moreover, aircraft such as the 737, A320 or Embraer E190, among others, carried up to 75 per cent of passengers on more than 70 per cent of the world’s commercial aviation routes, supported by the proliferation of low-cost carriers and airlines in developing and emerging markets.

Those upward revisions were offset by reduced expectations for deliveries in the large aircraft segment, comprising the 747-8F (freighter), 747-8I (passenger) and Airbus A380.

The company now expects just 540 new aircraft deliveries of large widebodies over the next 20 years, a reduction of 80 aircraft from the 620 forecast in the 2014-2033 CMO.

Most of the downward change was tipped to come from Asia, where demand for these very large aircraft was reduced to 140 frames over the next 20 years, 70 aircraft below the 2014-2033 prediction of 210.

Boeing has traditionally regarded the very large aircraft segment as a small market, believing just a handful of airlines around the world had the route structures and capabilities to successfully utilise an aircraft with more than 400 seats.

And Tinseth said many of those routes had now been filled by existing large aircraft. Moreover, airlines were increasingly attracted to new small and medium widebodies given their compelling operating economics.

“We recognise that, we make adjustments to the forecast that are in line with the realities of the market that we see today and developing in the future,” Tinseth said.

“It’s been a market segment frankly that we have overestimated demand.

“If you can’t fill a big airplane you are going to choose something that will ensure you will be able to make money. It is all about risk and reward.”

Sales of both the A380 and 747-8 have been slow, with no new orders for the Airbus doubledecker superjumbo in 2015 and the production rate of the latest version of the 747 due to be trimmed to 1.3 aircraft a month from September, down from 1.5 a month currently.

Tinseth said the recovery in the cargo market would help support orders for 650 new large freighters (more than 80 tonnes) over the next two decades, representing between two to three new deliveries a month.

That should spur demand for the 747-8F, and help support production of the current 777 ahead of the 777X’s expected entry into service in 2020.

“I believe this is good news for the 747-8 production line because it means strong demand for those airplanes over the next several years,” Tinseth said.

“It also bodes well for our 777 family as we work a bridge between today’s 777 family and the 777X in the future.

“Big freighters are needed, particularly in the Asia Pacific.”

The overall freighter fleet was forecast to increase to 2,930 in 2034, from 1,720 in 2014.

Tinseth noted the retirement rate for aircraft had tripled over the past 15 years, rising from less than 200 aircraft a year in 2000 to somewhere between 500 and 600 aircraft a year in 2014.

It was expected that two to three per cent of the existing airline fleet was expected to be retired each year over the next two decades, which Tinseth said provided “a very strong base for our production moving forward”.

Airlines in Asia represented the bulk of expected new deliveries over the coming 20 years, with 14,330 new aircraft tipped to enter service in that period.

“The low-cost carrier (LCC) business model has proved successful throughout the world but particularly so in Asia Pacific,” the Boeing CMO said.

“Over the past 10 years, the region’s LCCs have generated an average annual growth rate of 24.5 per cent. By comparison, Europe’s LCCs grew 13.4 per cent annually during the same period, and North America’s grew a modest 2.2 per cent annually.”

The forecast for Asia was up from 13,460 new deliveries in the 2014 CMO.

The Boeing presentation noted 78 per cent of capacity growth between 2013 and 2014 was achieved through additional frequencies, with 14 per cent coming from new direct routes and eight per cent through upgauging with larger aircraft on existing routes.