Virgin Australia will end flights between Melbourne and Hong Kong, as well as reduce its Tigerair Australia and regional fleet by five aircraft, as part efforts to return the airline group to profitability.

The fleet changes would lead to a two per cent reduction in domestic capacity in the second half of 2019/20, Virgin Australia chief executive Paul Scurrah told shareholders at the company’s annual general meeting in Brisbane on Wednesday.

The airline group had already reduced capacity by 1.5 per cent so far in the current financial year.

“Flying to the right destinations, with the right customer demand, and the right sized fleet will improve our financial performance,” Scurrah said in prepared remarks.

Virgin Australia started flying between Melbourne and Hong Kong in July 2017 with Airbus A330-200s configured with 20 business class seats with direct aisle access for every passenger and 255 in economy at eight abreast.

The airline added Sydney-Hong Kong nonstop flights a year later, with both routes served as part of an alliance with HNA Group.

However, flights to Hong Kong have been impacted by the recent political unrest in the Special Administrative Region, which has been rocked in recent months by massive demonstrations.

Scurrah said Virgin Australia’s Melbourne-Hong Kong flights had “continued to underperform in line with the political landscape”.

“We feel it’s best served through Sydney,” Scurrah said.

The last flight on the Melbourne-Hong Kong route will be on February 11 2020.

Other routes changes announced on Wednesday included the end of nonstop Canberra-Perth services from December 6 2019, Gold Coast-Perth from January 19 2020 and Sydney-Christchurch from April 29 2020.

While Melbourne-Hong Kong was being withdrawn, Scurrah said the upcoming launch of nonstop Brisbane-Tokyo Haneda flights from March 29 2020 was a “great opportunity”.

A refocus for Tigerair Australia and Virgin Australia

Scurrah said network changes for Tigerair Australia and Virgin Australia was “about getting the balance right”.

“There are many instances where we have both aircraft operating on the same routes at the same time,” Scurrah said.

“For example, we’re looking to focus Virgin Australia on routes that have a business and leisure orientation.

“We’re also looking to re-focus Tigerair flights on key holiday destinations.

“Other changes see us exiting uneconomic routes and selecting more profitable ones.”

Scurrah said two Airbus A320s would be removed from the Tigerair Australia fleet. Currently, the low-cost carrier (LCC) had 11 180-seat A320s and four 186-seat Boeing 737-800s in its fleet, according to the airline’s website.

Virgin Australia said the two A320s were being withdrawn as Tigerair Australia was dropping three routes – Brisbane-Darwin and Proserpine-Sydney would end on February 2020, while Adelaide-Brisbane services would end on March 29 2020.

Meanwhile, three Fokker 100 regional jets were leaving the fleet.

“We are seeing continued softness in the market, compared to a very robust first half last year,” Scurrah said.

“However, we are continuing to manage capacity very tightly. We are ensuring we’re meeting market demand with the right capacity.

“We’ll continue to be watching that with laser focus to ensure that we keep the cost down during a challenging period.”

In 2016, Virgin Australia announced plans to transition its Tigerair Australia fleet from A320s to 737-800s.

In addition to the end of Melbourne-Hong Kong flights, Virgin Australia announced on Wednesday it planned to re-enter the Melbourne-Denpasar market with nonstop flights using Boeing 737-800 equipment from March 29 2020.

Scurrah said it had previously been a “very profitable” route in the airline’s network.

Virgin Australia ended flights between Melbourne and Denpasar in 2016, when it handed the route over to its low-cost carrier (LCC) unit Tigerair Australia.

However, the LCC was forced to end its services to Bali from Adelaide, Melbourne and Perth in early 2017 due to an impasse with Indonesian regulators. Virgin Australia has been absent on those three routes since then.

Other route changes included reducing Sydney-Tamworth from daily to six flights a week and Sydney-Auckland to double daily, from 19 return flights a week.

On the other side of the ledger, Virgin Australia said it planned to add four additional flights a week on Sydney-Port Macquarie and increase its Adelaide-Brisbane schedule with five more flights a week.

Despite the current conditions, Scurrah described the domestic market as a “fundamentally a very strong, attractive” market, noting there had been a compound annual growth rate of 3.5 per cent since 2000.

Further, Virgin Australia had a “strong position in a good, two-player industry that is growing”.

Meanwhile, international passenger numbers were rising, driven by a growing middle class in countries such as China, India and Indonesia.

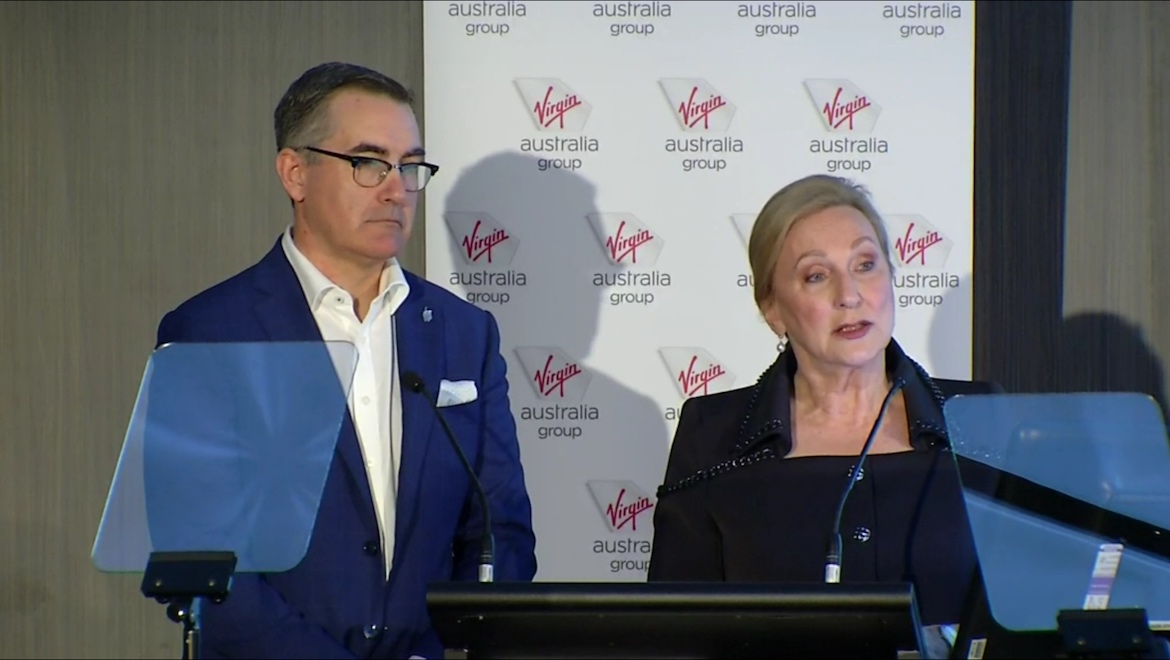

Although both Scurrah and chairman Elizabeth Bryan declined to provide an estimate or timeline when the airline would return to profitability following seven consecutive years of annual losses, the chief executive said the focus on capacity, revenue quality and cost management were the “ingredients that will help us succeed in turning our business into a profitable position”.

“We are reorienting the focus away from market share, revenue growth and network growth towards profit, cashflow generation and return on investment,” Scurrah said.

Bryan said the airline group’s was “very pleased” with Scurrah’s early decisions since taking on the role in March.

The Virgin Australia chairman noted the decisions during Scurrah’s initial months as chief executive included postponing first delivery of the Boeing 737 MAX until 2021, commencing a fleet and network review and restructuring the management team, as well as removing 750 corporate roles.

“The appointment of a new CEO was a critical one for the board and our focus was on ensuring the person had a strong ability to improve our business,” Bryan told shareholders at the company’s annual general meeting in Brisbane on Wednesday.

“That person was Paul Scurrah, who has a proven record of driving profitability. We set him a clear mandate to return the company to a profitable position and the board is very pleased with his early decisions.”

Al

says:Interesting decision on Hong Kong given the recent changes VA have been making.

VA have already made reductions on HKG-SYD pulling aircraft from this route and pushing passengers onto the MEL flight with a domestic connection to SYD.

More recently they have reduced frequency further.

Our inbound flight to SYD this month was canned 8 weeks ago and then 4 weeks ago the outbound to HKG was canned requiring domestic sectors in each direction vis MEL.

Needless to say adding close to 8 hours of extra travel was not on. We took the refund and are now on direct QF flights.

Non Ya

says:Give it a couple years before the new BNE-HND route gets scrapped too. Shouldnt have ever been granted to Virgin in the first place but I hope I am proven wrong and that this route goes well.

Harrison

says:“We’re also looking to re-focus Tigerair flights on key holiday destinations. In my eyes that just another way of saying Tigerair will come back to the Sunshine Coast very soon

John Doe

says:Why doesn’t virgin enter the Avalon market. They’d clearly make money there. Jetstar flights are always full and expensive.

Rod Pickin

says:I too have a positive view on the Virgin announcements as a much needed change in plan had to occur. Sure there has been some pain for a few but from experience, look forward not back. HKG had to be a problem at the moment for them but I guess that hickup saved them from having to obtaining another A330-200 to service the new HND ops. I expect the B737-800 wingtip scimitar conversion to some A/C will be utilised on the MEL DPS route so it would be interesting to see the fuel benefits of those conversions on that sector. Overall, Virgin Australia is its own entity; it is not a clone of QF, it has its own DNA and should be proud of it. The nature of the business is that sometimes it retracts and sometimes it expands but on this occasion it is change for the better. An interesting point, will the 3 VRA F100’s be taken up by Alliance?. – Best wishes

Lechuga

says:Hong Kong was always a strange choice in my eyes, not so much saturated but stretched about as well as it could get with Qantas and Cathay Pacific and without any major codeshares into Hong Kong. My personal belief is that Singapore would’ve been a more ideal choice, an ever growing destination. A more attractive stop over for connecting passengers to Europe, India, Africa and other points in Asia. Would have been a better point for VA to set up more codeshare partners too.

This is purely my opinion as an “armchair expert” but I do believe they chose the wrong destination/connecting point. Yes, Qantas and Singapore Airlines heavily operate through there, but it’s a far different market.

RHeaton

says:Tigerair utilises A320’s very well, yet the decision to remove A320’s in place of old used up 737’s from Virgin is pretty dismal. I say this because the C.O.O revealed that the demand for A320’s is in VARA and they will expand!

So why would you get rid of A320’s in Tigerair and then use them in VARA? Seems like a crazy decision, and it is. All for management bonus’s I would say as any ‘synergy’ is a myth considering VA have Boeing numbers to be fine and if you actually expanded Tigerair with A320’s you would have the same cost efficiencies! Its like the managers have never run an airline before! So its profitable to run smaller numbers of A320’s in VARA than a low cost carrier?! screams incompetence

Stu Bee

says:Sadly VA suffered under Borghetti in his attempt to show QF that they choose the wrong man… Hope to see VA get back into profitability.