Virgin Australia chief executive Paul Scurrah says the decision to cut 750 jobs is a difficult but necessary one to best ensure the airline group has a workforce that better matches the scale of its operations.

The 750 jobs to go will be mainly corporate and head office roles and represented about 7.5 per cent of the company’s total workforce, Virgin Australia said in its 2018/19 full year results presentation on Wednesday which showed a seventh consecutive annual loss.

The move was expected to save $75 million, with the bulk of the 750 roles to have gone by June 30 2020. It was one of several initiatives designed to support a return to profitability.

Scurrah said he told employees of the expected job losses in a lengthy video message on Wednesday morning and would be speaking with staff in a series of face-to-face “town hall” meetings around the country in the week ahead.

“Decisions like this which have a direct impact on our people’s livelihoods are never ever made lightly, and I am acutely aware of the the impact this will have and is having on our team,” Scurrah told reporter during a conference call outlining Virgin Australia’s 2018/19 results.

“However, if we are to position the business for the future and continue to deliver for our customers, and if we are going to drive strong competition in the markets in which we operate, we need to make difficult but important decisions that are in the long-term interests of the group.

“We have seen employee costs and the associated overheads increase and we have made the decision to reduce the size of our workforce to better match the scale of our operations.

“Reducing the size of our workforce is a difficult yet necessary measure to ensure we reduce our costs.”

Also, Virgin Australia said there would be a salary freeze for staff at the middle-management level and above not covered by an enterprise bargaining agreement (EBA) for 2019/20.

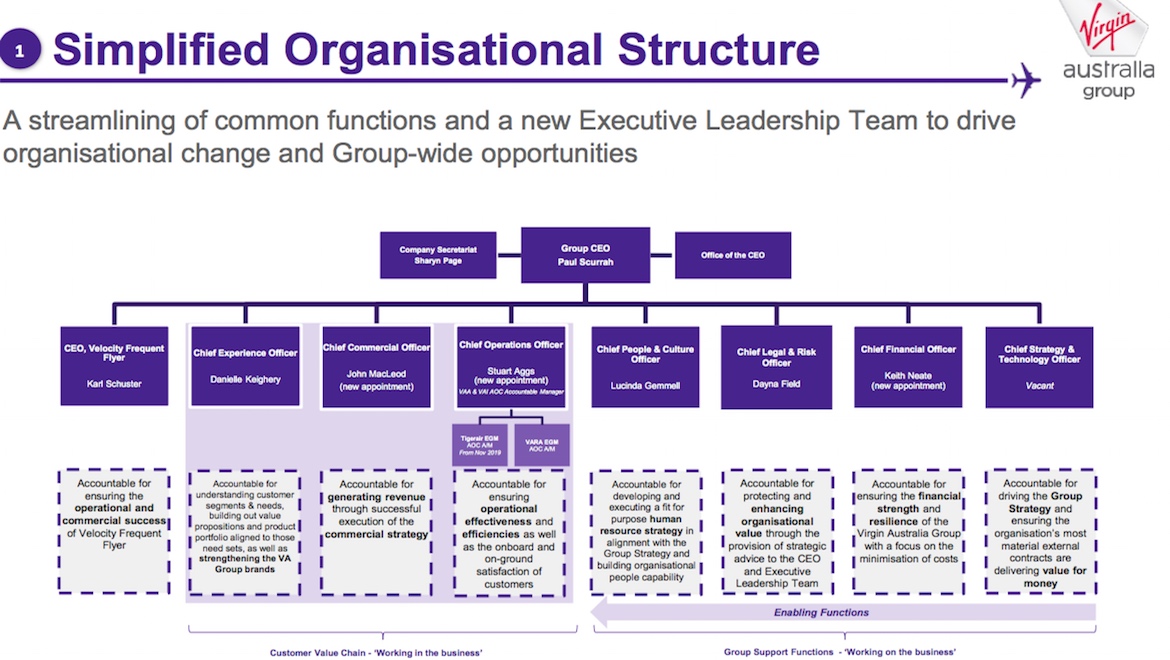

In addition to job losses at head office, Scurrah has also unveiled a new, simplified organisational structure for his executive leadership team designed to bring the three flying businesses – Virgin Australia, Virgin Australia Regional Airlines (VARA) and low-cost carrier Tigerair Australia – closer together.

Under the new structure, Tigerair Australia and VARA would be run by an executive general manager accountable for the relevant air operator’s certificate and reporting to chief operations officer Stuart Aggs.

There will also be two new roles, the previously announced position of chief commercial officer and a newly created position of chief experience officer to be held by John MacLeod and Danielle Keighery, respectively.

Scurrah said Virgin Australia’s organisational structure had grown “overly complex” over time as it acquired new businesses and established a portfolio of brands to compete in different segments of the market. This had added cost and duplication.

“Having group accountability at the executive level will deliver significant financial, operational, technological benefits,” Scurrah said.

“The structure will streamline our approach towards market and brand segmentation, the decisions we make around pricing, product, capacity and scheduling, our cost base by removing duplication and business opportunities that will help us to grow,” Scurrah said.

“It’s important that at the executive level we have a team that are working together to drive change and deliver better financial outcomes for the group.”

Virgin Australia said it was also targeting $50 million in annual savings through reviewing its contracts with suppliers such as aircraft lessors, airports, maintenance and other “strategic supply agreements”.

There was also an ongoing review of the airline group’s fleet, network and capacity.

Virgin Australia said it reduced capacity across its network by 1.5 per cent in the three months to June 30 2019 and foreshadowed further reductions in the first half of the current financial year.

“The group intends to further reduce flying across elements of its short-haul international and domestic network to meet demand and maximise route profitability, and expects H1 FY20 capacity growth to be negative,” Virgin Australia said.

The reference to short-haul international suggests Virgin Australia intended to, for now, maintain a presence its two long-haul markets of Hong Kong (served with Airbus A330-200s) and Los Angeles (served by Boeing 777-300ERs).

Virgin Australia has already pushed back delivery of the first Boeing 737 MAX to 2021.

It is also continuing the process of transitioning the Tigerair Australia fleet from Airbus A320s to Boeing 737-800s.

Virgin Australia said cost per available seat kilometre (CASK) across the airline group, excluding fuel and foreign exchange, rose by four per cent in 2018/19.

“Our financial performance is disappointing and certainly underscores the need for change at the VA group,” Scurrah said.

“Our costs have increased and we need to work on managing these to ensure we are seeing the financial benefit from the business and revenue growth.

“There is more to do, much more to do.”

In terms of market conditions, Scurrah said the softness in the market in the second half of 2017/18 had continued into the current financial year.

“We are seeing some signs of a recovery but it is a little early to tell whether that is sticking or not,” Scurrah said.

Merren McArthur and Geoff Smith leaving

It was also announced on Wednesday that chief financial officer Geoff Smith would be leaving the company at the end of the year to “explore new opportunities”. Keith Neate will return to Virgin Australia in September as chief financial officer, having held the role during the Virgin Blue days.

“Geoff has helped lead our business through a significant period of growth and transformation, completing the Group’s significant capital raising with major shareholders in 2016 and leading our financial management through a challenging phase in our Group’s history,” Scurrah said.

“I am grateful to Geoff for his ongoing support through the transition period and want to thank him for his contribution which has been invaluable for the Group. I wish him well for his future endeavours.”

Further, Tigerair Australia chief executive and Virgin Australia acting chief commercial officer Merren McArthur had advised her intention to depart the airline group.

Virgin Australia said McArthur would stay on as Tigerair Australia chief executive as it transitioned to the new structure and continue as acting chief commercial officer until MacLeod started in the role in October 2019.

“After 11 years, Merren has decided it’s time to move on from the group and pursue other opportunities,” Scurrah said.

“She’s been an integral and highly respected member of the executive leadership team for many years and I’m grateful Merren will continue as Tigerair CEO to help guide the business through this transitionary period. I’d also like to thank Merren for acting as VAA chief commercial officer over the past three months.”

Peter

says:Just hand it all over to Alliance. They’ll turn a profit. Maybe that’s what QF were hoping for when they secured their 19.99% stake.

Neil Hansford

says:Regrettably everything I read here are “band-aid” measures. What is not attacked is the “founders culture” that still is across VA.

If VA is to stay viable REAL decisions need to be made and the biggest of these is trying to replicate Qantas with over 65% of the domestic market and the enormous power of Qantas Frequent Flyer. It is time for a Virgin Lite and not try to be all things to all pax on a comprehensive network.

Real men with a competent board of airline professionals not tokens make hard decisions and what is released isn’t that. The Chinese/Emirati shareholders who are in the majority have different goals than what is good for Australian travellers

ian

says:yes way too many chiefs & not enough indians.

An associate was trying to buy 400 seats over various dates to USA from VA. He got handed around so much, in the end he gave up & went to another airline, who basically said, how much do you want to pay & how do you want to pay.

It seems many people are still be conned by much of the media, that we are not in a recession.

Peter

says:Seriously, this is needed. VA management and Tigerair management are very incompetent. Sad, but that explains why VA is in the state it is in!

Merrin, I told her to her face that she wouldnt be here for more than two years…. I wish I placed her a bet now.

Honestly, Tigerair has been mimanaged from the initial VA buyout. JB kept it small because he hated us and didnt want the competition.

Now, his crazy plan to swap out Airbus for Boeing is still going ahead, even after MILLIONS of dollars has been wasted in that endevour. Seriously, you have qualified Airbus drivers and poorly managed A330’s at VA….. why arent the 330’s being integrated into Tiger? Why are they wasting money swapping crew over to boeing? Smells like another CEO KPI bonus and/or Boeing bonuses!

Mike

says:Anybody remember August 2014 when Qantas recorded a $2.8 billion loss? Look where the company is today. Things certainly don’t look good for Virgin Australia right now. With a new CEO at the helm, in five years from now….only time will tell.

Rod Pickin

says:Mike, I certainly do remember that QF loss report and I maintain that QF has the best accountants in the world too . From memory, that reported loss resulted from a total write off of their B747 fleet in that financial year allowing following years to be more financially attractive as indeed they have! Regarding our “Virgin” problem and with respect to their board players they have in the past, it would appear, been overrun by a marketing whiz who had absolutely no idea as to financial expenditure needs and controls, a fact that I am sure was not overlooked in the appointment of Mr. Joyce to the position of QF CEO. Virgin will rise again, there are a few good people in their board who know about correct management.

Tony

says:I bet Air New Zealand is pleased they got out when they did despite taking a financial hit.

Adrian P

says:Perhaps some flights out of Avalon might reduce the costs.

All that infrastructure at Melbourne Airport is not cheap .