International Air Transport Association (IATA) director general Alexandre de Juniac says regulators and airports need to move quicker to keep pace with the expected growth in passenger traffic.

de Juniac’s call came as IATA released its 20-year forecast, which showed passenger numbers expected to reach 8.2 billion by 2037, more than double the four billion that flew in calendar 2017.

“We don’t see actually the necessary, unavoidable and key decisions made to ensure that the infrastructure will be able to cope with the growth,” de Juniac told reporters during a conference call on October 24.

“Some regions of the world are more lagging behind in air traffic control, some others are late in terms of airport development.

“But everywhere we have an infrastructure shortage and we urge governments to make the right decision quickly because all these programs they take between five and 10 years to be implemented and to be in service.”

China set to top the rankings as aviation shifts east

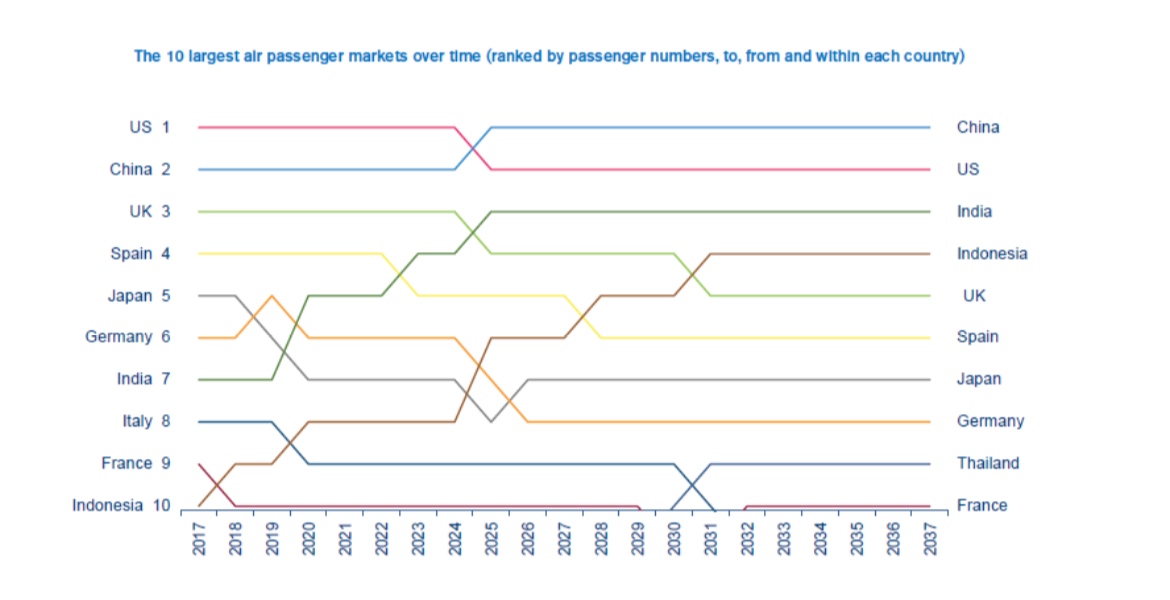

The IATA forecast noted China would replace the United States as the world’s largest aviation market in the mid-2020s, part of what IATA described as an eastward shift in aviation’s centre of gravity.

(IATA defined an aviation market as traffic to, from and within a country.)

Closer to home, the outlook tipped Indonesia to rise from the 10th largest market in 2017 to fourth by 2030 behind China, the United States (2nd) and India (3rd).

And Thailand was tipped to vault into the top 10 in ninth place by 2030.

More broadly, the number of passengers travelling on routes to, from, or within the Asia Pacific region was expected to reach 3.9 billion passengers by 2037, an extra 2.35 billion flyers compared with today. IATA said Asia Pacific would be the fastest growing aviation region ahead of Africa and the Middle East.

Protectionism a threat to growth

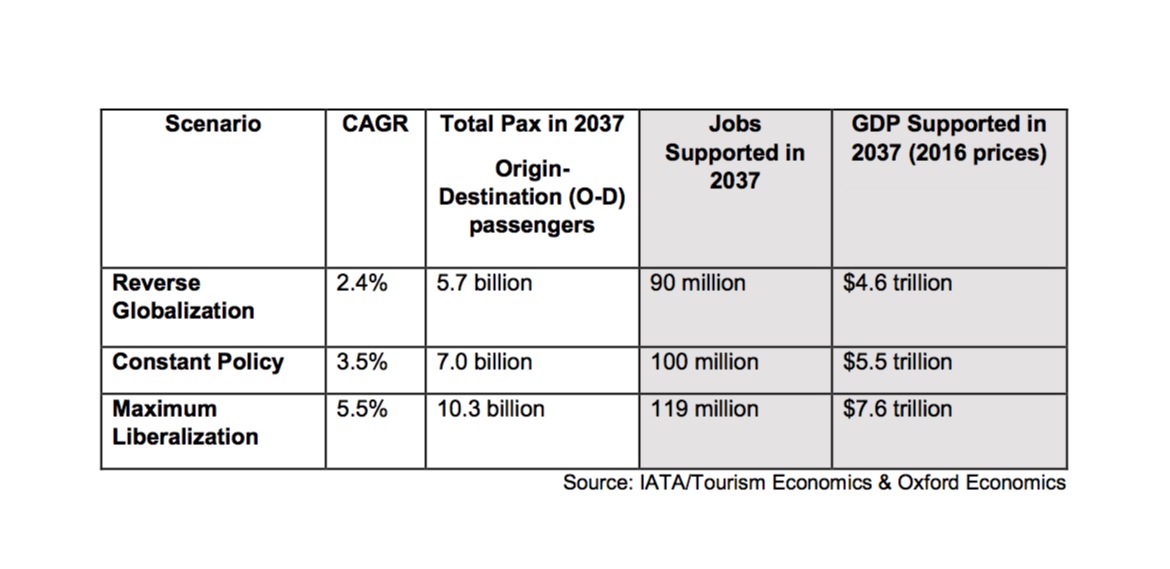

The forecasts were based on a 3.5 per cent compound annual growth rate (CAGR) and assumed an unchanged policy framework over the next 20 years.

However, de Juniac said the recent rise in economic protectionism in several markets – particularly the use of trade tariffs – had cast a shadow over world trade and prompted IATA to trim its previous CAGR estimates.

“When we looked at the forecasts eight months ago it was based on a growth rate of 3.6 per cent for the next 20 years,” de Juniac explained.

“And the forecast we have now is based on 3.5 per cent. The difference is essentially due to protectionist measures and the consequences of protectionist policy on air traffic.

“It is still small, 0.1 per cent, but you must know that 0.1 per cent on 20 years means 60 million passengers less in 20 years than the other scenario.”

Further, de Juniac said the forces of economic protectionism were “casting a shadow over world trade” and risked the further slowing of passenger growth to as little as 2.4 per cent annually.

Meanwhile, IATA chief economist Brian Pearce said the escalating trade wars among the major developed nations was impacting the cargo market.

“We see the impact of the growing trend towards protectionist most obviously in the cargo sector,” Pearce said during the conference call.

“We are still seeing very strong air travel growth but actually what we have seen are increasing border frictions and so cargo is growing quite slowly at the moment. That is where the impact is most obvious.”

“We should bear in the mind that really in the last decade we have seen a much more protectionist trend in the world, the latest of which are the tariff wars, but we have seen this for some time and is very apparent in the cargo business which is much more slow growing.”