Qantas plans to offer members of its frequent flyer program the opportunity to earn points from keeping fit as part of a new partnership with health insurance provider nib.

The new program, called Qantas Assure, aims to capture between two and three per cent of Australia’s $19 billion health insurance market over the next five years.

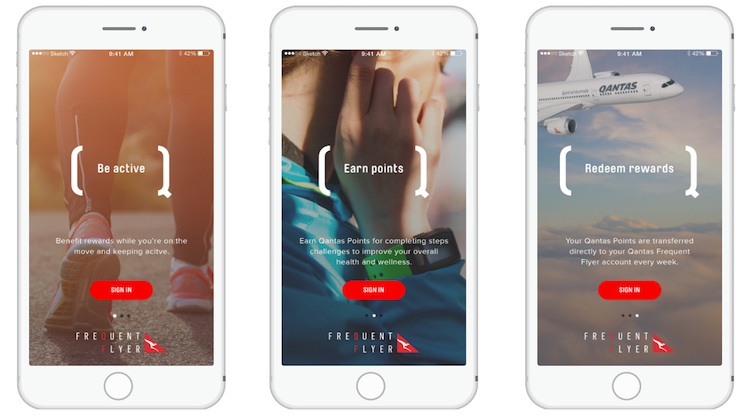

Qantas Assure will market nib’s health insurance policies to the airline group’s near 11 million frequent flyer members, who will earn points from paying their premiums as well as get “rewarded” with points from completing various challenges such as walking a certain number of steps.

The physical activity will be tracked by a wellness app due to be launched in 2016 that will link up with various forms of wearable technology.

“This is not about simply earning points when you pay a bill. It’s about offering members the opportunity to be rewarded for being more active, which is something that also has a direct impact on improving your wellness,” Qantas chief executive Alan Joyce said in a statement on Monday.

Qantas Loyalty chief executive Lesley Grant described the initiative as “deliberately different”.

“The idea behind Qantas Assure came from our members telling us they want to be rewarded for leading a more active lifestyle,” Grant said.

“When members combine the Qantas points they can earn from literally walking around the block with all the other ways to earn, it becomes a very powerful proposition.”

nib’s managing director Mark Fitzgibbon said the partnership had the potential to improve the health and fitness of its members and lower health care costs.

The Assure program is the latest initiative from Qantas’s loyalty division, which has been busy setting up a number of different, or adjacent, businesses in recent times to provide what the company describes as a “stable, cash positive growth vehicle for the group’s earnings profile”.

There have been consumer focused programs such as the Qantas cash debit card, Qantas Golf, wine-focused epiQure and the Aquire small business program.

The loyalty division also features analytics and actuarial consulting firm Taylor Fry and data marketing business Red Planet, which uses data from Qantas’s frequent flyer program to create targeted digital advertising for other businesses and was launched in 2014.

The use of so-called big data has become a significant marketing tool for not just airlines but all consumer-focused industries such as banks and telcos, allowing firms to offer more targeted offers or communications with customers and members.

This more personal approach to marketing and communications was discussed during at the 2015 International Air Transport Association (IATA) annual general meeting in Miami, where airline bosses raised the prospect of customers being offered airfares based on their place of residence and flying patterns rather than demand.

Vueling chief excutive Alex Cruz said it would be inevitable the way airlines price tickets would change as the technology developed.

Meanwhile, Joyce said during a panel session at the IATA meeting his airline’s frequent flyer members wanted more individual offers.

“You will identify what a customer wants and deliver the appropriate product and the appropriate price for the customer,” Joyce said during a June 7 panel discussion.

“That is the way things are going longer term and that is what our customers want.”

Qantas’s loyalty division reported underlying earnings before interest and tax (EBIT) of $315 million in 2014/15, up 10 per cent from the prior corresponding period.

R

says:Any chance QF are offering said health products to get their passengers to shed a few kilos so flights are a little lighter on fuel? or so they can squeeze more seats in?

Not a bad idea actually after the two Shrek look-a-likes I got stuck inbetween on a flight recently, spilling under AND over the armrest while they hoovered their pork pies and pepsi.