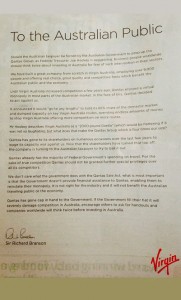

Virgin Australia founder and shareholder, Sir Richard Branson, has taken out full page open letter advertisements in Australia’s Sunday newspapers on February 16 calling for the Australian government to not “prop up the Qantas Group.”

Branson’s letter warns that “business people worldwide will think twice about investing in Australia” for fear of government intervention in their sectors. The letter quotes Treasurer Joe Hockey’s February 13 comment where he called Virgin Australia “a 2,000 pound Gorilla,” and asked rhetorically “what does that make Qantas?”

“Qantas has gone to shareholders on numerous occasions over the last few years to wage its capacity war against us,” Branson said. “Now that the shareholders have turned that tap off, the company is turning to the Australian taxpayer to bail it out.

“We don’t care what the government does with the Qantas Sale Act,” he continued, adding “what is most important is that the government doesn’t provide financial assistance to Qantas, enabling them to reinstate their monopoly. It is not right for the industry and it will not benefit the Australian travelling public or the economy.”

In a February 12 speech to the Transport & Tourism Forum, Qantas CEO Alan Joyce stressed that he had not sought a handout from the government, but added that “when one set of rules applies to Qantas, and another to our competitors, then a clear distortion exists.”

Redneck

says:It is not before time that we give this g**b the push right out of Australia , as he has never operated in Australia’s interest . We should take no notice of him.

Andrew Garde

says:Australians should think long and hard about any support for Qantas. In the 60’s 70’s and 80’s TAA ( Qantas Domestic) always waited until another airline pioneered and established a route ( think Proserpine and Hamilton Is), then move in to grab market share , as though they were entitled to it. QF/TN also happily went along with the 2 airline policy against East West. Although long ago, QF seem to still have that sense of entitlement. Always wanting it all their own way. I for one, admire DJ/VA , for providing some real competition against the QF/JQ behemoth .. and with a cheery smile .. and they actually go a long way to-wards making flying a pleasure. The nations governments leaders have always got their snout so far into the Chairmans Lounge trough, that they seem incapable of rational decisions. QF USED to be a National Icon .. it is no longer, more a national joke … . Qantas is a private company, and should live or die on it’s own management decisions. This argument about the QSA is rubbish .. nearly all those “limits” have not been reached, and I don’t see any listed carrier among the top 20 shareholders … least of all the 35%.

I also wonder, if “we” guarantee QF debt, how do we stop the money we “guarantee” being filtered away to JQ ventures in Asian countries, so we sponsor idle A320’s sitting idly at Asian airports .. earning nothing, but that is Ok .. the taxpayer has guaranteed the debt !

Sam

says:I wouldn’t call the govt acting as a debt garentor a “hand out.” From what I gather, the australian tax payer would only have to pay if qf were to default on its loans, under the coalition’s plan.

Philip Smith

says:Well well did he say that Virgin is backed by 3 Foreign airlines whose Major shareholders are the government of those countries.

Also why did sell out a share holding of Virgin Atlantic.

He is just a hypocrite and the sooner we hear less from him the better.

The sooner we have a level playing field the better or Virgin should go under the same rules as Qantas 49% Foreign owned.

australianaviation.com.au

says:Lets try to keep this debate sensible folks, no need for any personal or racial jibes directed towards any of the protagonists.

Cheers

Andrew

Miles Harrison

says:Its very simple the solution, change the foreign ownership laws so Emirates etc can buy into Qantas and means that our tax payer money is not going into propping up a private company. It will mean a secure Qantas although the unions will not be happy as they will have to accept new pay conditions for their members. These are long overdue at Qantas.

Cheers

Miles

Lorenzo

says:Well said Andrew Grade, I agree with everything you have said. I don’t think we need to aiming any guns at Sir Richard Branson, the guy is a business genius. The way VA is being run is great, they bring competition to the market which can only benefir the consumer. They will bring the end of QF eventually and what that looks like who knows. But its definitely going to be a good thing. I suspect that the end of QF looks like a complete change of management and being shifted into a new direction. I personally think QF needs to start again from scratch, it is such a messed up company. Everyone is sick of seeing QF dictate the rules and bully other carriers out the market and it has only been due to the share size of QF. Change is coming for QF and once it has all been dealt with we are going to see some great Australian Airlines back dominating world aviation.

Craig

says:Qantas says it has plenty of cash and assets why does.it need a government guarentee more bs from a ceo who once worked for ansett

Douglish

says:If Virgin put 100 seats to a spot, QANTAS has been putting 200 in there, even if they only sell 60. Planes have been leaving empty to keep this guys ego pumping.

Virgin staff ALWAYS are cheerful and helpful. Ever ride Jetstar? I think the only thing that needs changing is the CEO of QA/JS. He has been confrontational from word go and has lead the company firmly downhill.

A guarantee becomes an inescapable loan the moment the company defaults. There is no debate then about “will the taxpayer foot the bill or not”. There is NO option to keep the money in the pocket.

Let someone else who CAN run an Airline put up the cash. Ask Richard B if he wants in..

Henk Luf

says:A war of words between Qantas and Virgin is not going to assist neither of the two. I would much rather see Government make changes to the Qantas sales Act and then see what happens. With any doubt,, major Qantas changes will be required with or without its current board and management.

Overload

says:If this is about making the playing field level, then do it, remove the antiquated Qantas sales act and let them court suiters just like Virgin. To guarantee debt is far from levelling the playing field, it is flat out putting Qantas in a to big to fail club. To say one of Qantas qualifying points for backing is that ‘it is an essential service” is utter nonsense. Why? Because there is competition, Qantas is not the sole trader in aviation in this country. If your debt is guaranteed there is no risk in the game, except for the tax payer – This is not a level playing field, this is a gift!

On another point, when Qantas says it will maintain 65% market share at all cost (and it has cost them) regardless of whether they need the actual extra capacity or not must surly raise a few questions. How can QF say Virgin is capacity dumping when they have a open policy of 65% market share that must be maintained. So, Virgin puts on A330’s on it’s Perth services to offer a better product to its customers than the smaller 737 could provide, and Qantas for reasons other than offering a better service puts on more of the same product (aircraft) just to maintain it’s so called line in the sand. Now that sound like capacity dumping to me. But of course lets not question that!

Yes, Virgin has the advantage of not having the sales act around it’s neck, and yes it does have government backed airlines as share holders. Allow Qantas the same rules to play by and thus level the playing field (Emirates – government backed). Australia will end up with two much better airlines in the long run. Qantas is a fat heavy airline that cost too much to run with a flawed protect market share at all cost policy. This country needs strong sustainable businesses regardless of who owns them. Government should govern with policy, not by interfering with tax payers money in what should be a free market business. Many foreign companies operate legitimate sustainable businesses that employ tens of thousands of people in this country. If you want to go down the market protection path have a good look at Argentina and see what you end up with.

Remember Qantas you went straight to Canberra when Ansett collapsed and made it very clear they should not receive any government (tax payer) support, apparently Costello agreed!

John Harrison

says:As before it’s always good to read the “for and against” argument going on in the comments posted. I know I rather back Sir Richard Branson than QF’s CEO anyday. I remember Richard Branson saying many years ago, “Happy staff – Happy passengers – Happy share holders” and think that is still very true. Qantas should have the sales act removed or modified. So someone else can put money in, maybe Emirates, then see them (QF) improve. Or wouldn’t be interesting to see someone like Richard Branson buy into QF. (I realise he’s got more sense than that!)

Above all else, Qantas needs far better senior management to start with, and then see how they progress from there.

Not someone who is hell bent on putting his all into Jetstar, I guess we could all go on and on about this subject.

Geoff Ross

says:Andrew Garde says Qantas is a private Company. Wrong, Qantas is a public company. One of the biggest problem Qantas has is the position of the Jetstar companies in Asia. How much has Qantas transferred to these companies? It looks like years these they become profitable, if ever.

Justin

says:Re QF, i think Australians need to decide if they want their formerly sovereign airline to survive, because it is quite likely it is not going to, unless some concessions are made. We should think about the history of this airline, its contribution to our national history and pride and to aviation as the second oldest airline still in service in the world after KLM. It began in the private sector, then migrated into government service because of the war, and only in recent decades has it had to run the gauntlet of globalisation and public ownership. It certainly is a big part of our history, like ANA and Ansett and other regional airlines like MMA were before

.

Virgin though, as a late comer is a really wonderful airline, and necessary, but with a younger staff, lighter union obligations, and it filled the gap in its creation with the the collapse of AN. It was a good business deal for its creators at the time, after AN collapsed because foreign board members allowed it to, namely Air New Zealand and SQ.

If we consider what Air New Zealand now achieves, from a small country with a population less than Sydney, perhaps we can get some clues. partial government protection and ownership might be necessary. And creativity and enthusiasm, with public support and pride, might just do the trick for both QF and Virgin. Gulf airlines enjoy massive sovereign funds, as they strive to be everywhere.

we should consider what the Australian market means to them, and perhaps they should compete on a more level playing ground.

Andrew Garde

says:Sorry, Geoff Ross .. I meant to say the opposite ..a public company !!

Ben

says:Sir Richard is no stranger to ‘sticking it to’ the incumbent in many industries, but don’t forget that his foray into aviation started 30 odd years ago against the British flag carrier (something VS then took the Mickey out of with their maiden on the nose ‘carrying the flag’) and have been steeped in competition ever since.

BA is now part of an amalgamation of BA, KLM and Iberia. Partly because none of these legacy behemoths could survive alone. Unfortunately without the ability to invoke Chapter 11 like many US airlines, QF is eventually going to drown in it’s own policy, cost blowouts and union demands.

Justin, you can’t fairly compare QF to ANZ. ANZ is basically the only NZ carrier (excluding small parts JQ and VA and regional). They needed the right CEO for the job, Rob Fyfe fit that bill. Otherwise they were headed towards the same iceberg that Joyce seems determined to plow the QF group into. Borghetti is just sitting back and watching him do it. To continue with that metaphor, any form of debt guarantee or bail-out by the government will simply be like the Titanic movie… $3billion and it STILL sinks!

Ray E

says:Didn’t KLM merge with Air France while BA and Iberia formed IAG?

Jim

says:My understanding is that the Qantas Sales Act (QSA) already allowed foreign airlines to own individually up to 25% of Qantas (the international arm that is – not domestic or Jetstar which I believe are not covered by the QSA) and collectively up to 35% whilst maximum foreign ownership is limited to 49%. Whilst I support the removal of the QSA entirely, it seems that the entire Qantas media strategy around the inequity of the “playing field” is a bit of a furphy or and a “generous” stretching of the facts.

The real issue for Qantas is that even though the QSA allows a foreign airline to invest at a level similar to any of Virgin’s primary stockholders no airline seems to be beating a path to Qantas’s door. I would imagine this is concerning for the QF management which probably explains the desperation inherent in their current media strategy.

Boggles

says:I think emirates buy the intl part of the airline,maybe qantas might just be a domestic airline,at least domestic makes money.