Boeing says it has embedded its own staff at companies in its supply chain, including at engine maker CFM International, to support efforts to increase the production rate of the 737 to 57 aircraft a month.

For parts of 2018, the 737 program was affected by technical issues that led to delivery delays of both the CFM International LEAP 1B engine and fuselages built by Spirit Aerosystems.

Those issues resulted in up to 40 737 aircraft being parked around Boeing’s Renton facility at one point in the second half of calendar 2018 as it waited for engines to be delivered and other components to be installed.

Boeing said it was able to deliver 173 737 aircraft in the three months to December 31 2018 – including 69 in the month of December alone – which suggested the company was getting on top of the situation and able to clear some of the backlog.

However, the aerospace giant faces a fresh challenge as it presses ahead to increase the production rate of the 737 program to 57 a month during 2019, from 52 aircraft a month currently.

Boeing chief executive Denis Muilenburg says the entire supply chain is not yet in a position to make the step up in rate.

“We are moving forward on our plans to ramp up to 57 a month during the year,” Muilenburg said during Boeing’s calendar 2018 full year results presentation on Wednesday (US time).

“Some elements of the supply chain have already moved to that position. We still have some work to do before we move the entire line to 57 a month, and we’re going to be very, very disciplined in that process.”

Muilenburg said there was nothing unusual about Boeing placing some of its own staff at the factories of engine maker CFM and its sub-tier suppliers, describing it as a “typical process”.

“We still have work to go to get CFM to be supporting our 52 a month production rate and having those systems synchronized, and then even more work to go yet to get them ramped up to 57 a month,” Muilenburg said. “And that’s really what we’re focused on.”

“This is about production system ramp-up and synchronisation.

“By us getting deeper into their factories, it’s going to give us better insights on long lead items, and frankly, it will I think help us do best practice sharing between Boeing and CFM, which is part of how we operate that will make us better and it will make CFM better.”

CFM is a joint-venture between GE Aviation and Safran Aircraft Engines and is the sole-source engine supplier for the Boeing 737 program. The company also makes engines for the Airbus A320neo family of aircraft.

The MAX family features a new flightdeck, fly-by-wire spoilers and new technology winglets compared with the 737 NG on which it is based. It is powered by two CFM International LEAP 1B 176cm fan diameter engines, compared with the 155cm fan diameter CFM56 on the NG.

To accommodate the larger engine, the MAX incorporates a taller nose wheel landing gear leg, while the engine nacelles’ trailing edges feature noise-reducing chevron shaping, as also seen on the 787.

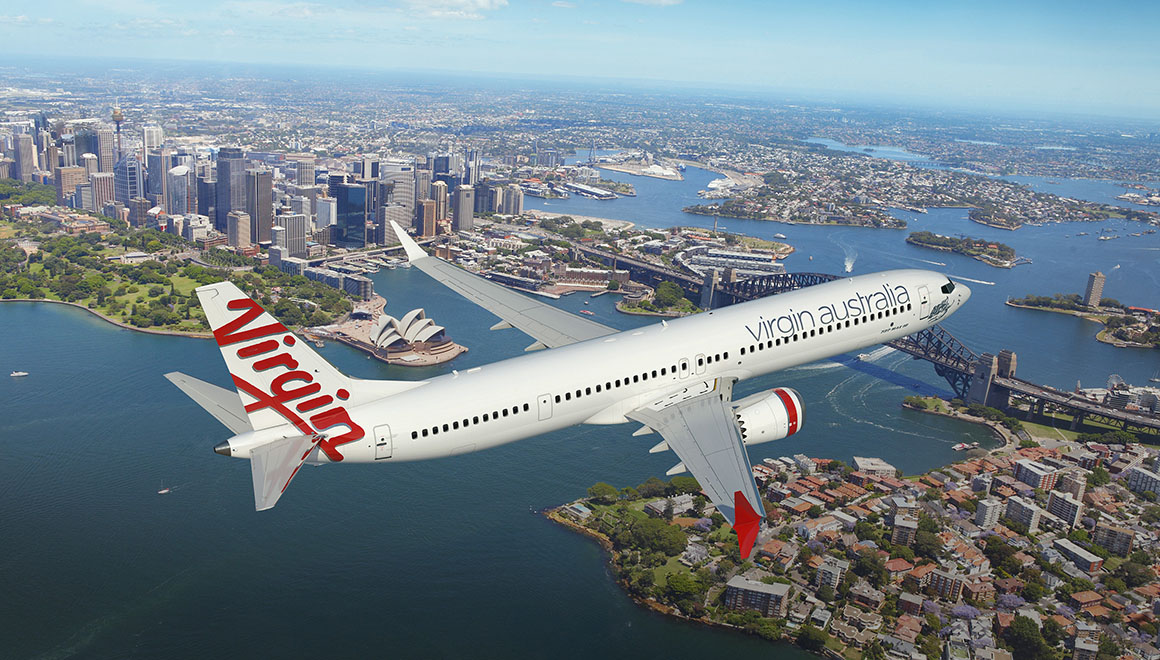

Airline customers in Oceania include Virgin Australia, which has a combination of 737 MAX 8s and 737 MAX 10s in its order book for 40 of the type.

Fiji Airways became the first airline in this part of the world to operate the 737 MAX when it took delivery of its first 737 MAX 8 in December 2018.

And Air Niugini has four 737 MAX 8s due to arrive from 2020.

Meanwhile, Qantas is expected to run a competition between the 737 MAX and A320neo at some future point for the replacement of its existing 737-800 fleet.

Analysis of new mid-market aircraft (NMA) ongoing

Muilenburg said the company was still planning to reach a decision on whether to proceed with the development of a new mid-market aircraft (NMA) some time in 2019, with the evaluation of the business case ongoing.

“As we’ve mentioned before, we do see a decision point this year, and that is a decision of whether we would offer the airplane in the market,” Muilenburg said.

“Assuming a positive market response or depending on the market response, we’ll make the final launch decision next year so it’s a two-step decision process, as we’ve always done with commercial airplanes, and a very disciplined process.”

Boeing has said previously it expected the NMA, which some have dubbed the 797, to comprise a two-aircraft family designed to carry between 225-275 passengers anywhere from 4,500-5,000nm. It would be powered by an engine capable of producing 50,000lb of thrust.

Entry into service was planned for 2025.

Qantas is one of a number of airlines that have publicly stated its interest in the proposed NMA.

Meanwhile, Boeing reaffirmed plans to commence flight testing on its 777X program later in 2019, with entry into service due in 2020.

Boeing reports lift in full-year profit

In terms of the financial results, Boeing reported net earnings, or net profit, of US$10.5 billion for calendar 2018, up 24 per cent from US$8.5 billion in the prior corresponding period.

Revenues rose eight per cent to US$101 billion, the first time in the company’s history turnover has toped the $100 billion mark.

Boeing has guided the market to expect total revenues for the current year to be in the vicinity of US$109.5 billion and US$111.5 billion.

Meanwhile, the company said it expected to deliver between 895 and 905 commercial aircraft in 2019, up from 806 aircraft deliveries in the prior year.

“We continue to see healthy global demand for our offerings in commercial, defense, space and services,” Muilenburg said.

“These are sizeable sectors that are growing and backed by strong fundamentals.”

While other firms have observed that the economic slowdown in China represented a major headwind for their businesses, Boeing chief financial officer Greg Smith said there was continued strong demand in China in terms of market dynamics.

However, Chinese airlines were likely to hold off from further aircraft orders until the release of the Chinese government’s latest five-year economic plan.

“In terms of our orders volume in China that’s typically paced by timing of their five-year planning,” Muilenburg said.

“So it tends to come in waves. So that’s why we, again, as we look to the future we expect to see some timing adjustments on orders, but overall volume over the long-term remains very strong.”

The trade tensions between the United States and China also had the potential to keep Chinese carriers from committing to new aircraft in the period ahead.

“I would note that as a global company with customers in 150 countries, we’re always mindful of the potential impact of geopolitical and macroeconomic forces,” Muilenburg said.

“We continue to track a host of near-term issues and mitigate potential risks as appropriate.

“We value and maintain strong relationships with our customers, suppliers and other stakeholders around the world, reinforcing the mutual economic benefits of the strong and prosperous aerospace industry.”

AA PODCAST #22: A look at the GE9X engine with with Ted Ingling

I Swann

says:Fiji Airways & Air Vanuatu going for 737 Max 8 and Samoa Airways taking possession of 737 Max 9 next month.