Randy Tinseth remembers the first time he visited Tokyo Narita Airport. It was 1989 and there were Boeing 747s lined up as far as the eye could see.

Fast forward a few years and those 747s had given way to Boeing’s latest widebody workhorse, the 777.

When Boeing Commercial Airplanes’ vice president of marketing visits Tokyo Narita today, the scene has changed yet again.

“Now it is as far as you can see 787s,” Tinseth told Australian Aviation in an interview on the sidelines of the Singapore Airshow in early February.

“You’ve seen this decline in the average seats per departure, but the number of destinations has doubled. We are seeing the number of destinations increase because of the flexibility of these smaller aircraft.

“And by doing so they are taking demand that goes from places like LA to Narita and they are redistributing it in a different way.”

The development of the 787 was predicated on offering airlines an economic twin-engine aircraft with sufficient range to open up new long- and medium-haul routes, as well as an effective asset to increase frequencies on existing routes.

Boeing figures show some 170 new nonstop markets have started since the 787 started flying with launch customer All Nippon Airways of Japan in 2011 and Tinseth described this network development as “even more dramatic than we thought”.

The aerospace giant is hoping to achieve a similar result for airlines with its much-discussed but yet‑to‑be‑launched new mid-market airplane (NMA) that some have labelled the 797.

“We are trying to take that dynamic, and recreate it to some extent in the middle of the market,” Tinseth said.

While details are thin on the ground, the study is focused on a two-aircraft family that would carry between 225-275 passengers anywhere from 4,500-5,000nm. It would be powered by an engine capable of producing 50,000lb of thrust.

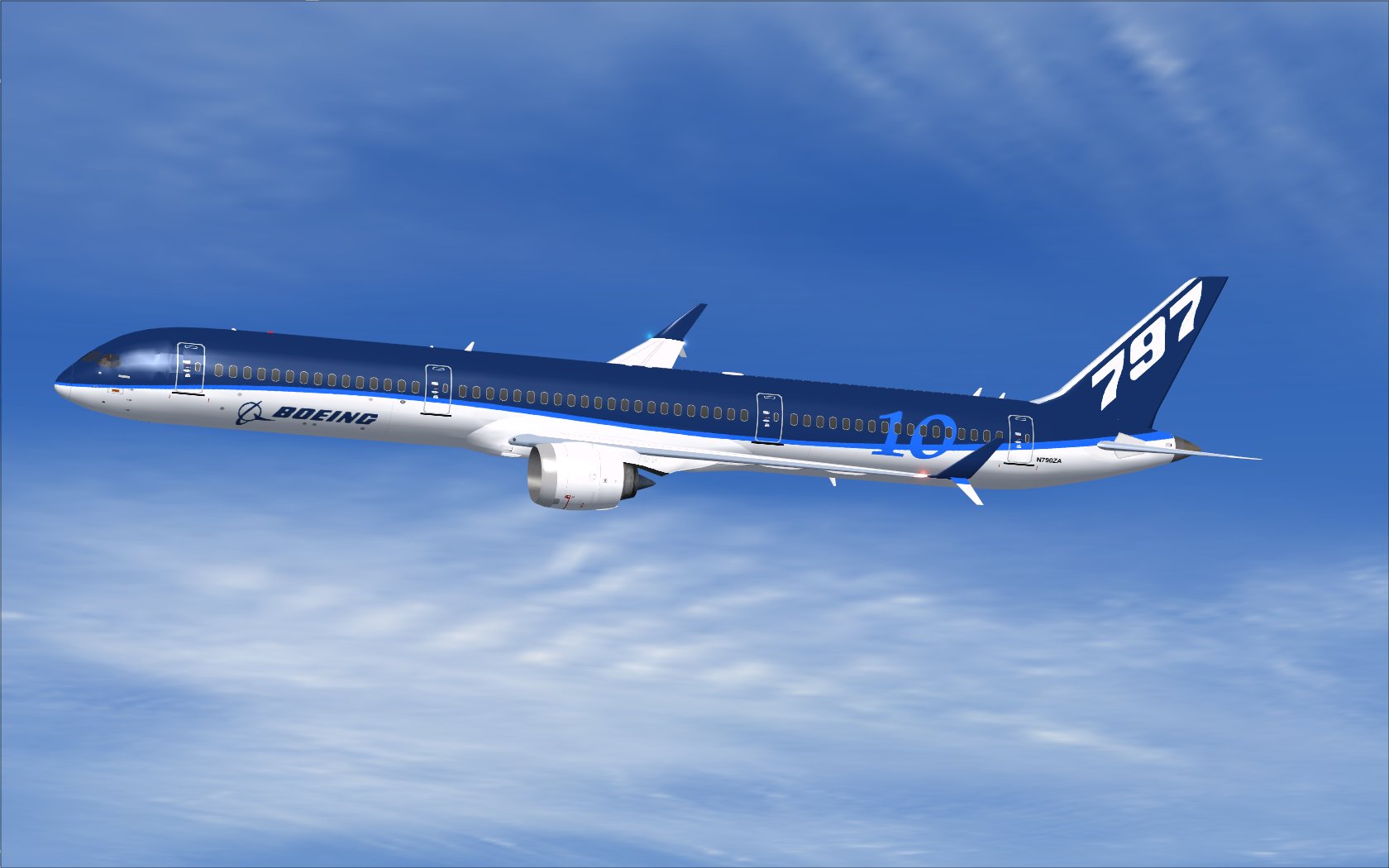

How the NMA might look was revealed in a blog post by respected aviation writer Jon Ostrower in early March. An image published on Ostrower’s blog shows a concept design that features a Boeing 767-style nose, 787-style wing and cabin windows and a 737 MAX-style tail cone.

The Boeing 797 of 2025 will evolve out of this 2018 conceptual rendering of the New Middle-Market Airplane. https://t.co/FQdJXvZfFP

— Jon Ostrower (@jonostrower) March 12, 2018

“Highly unlikely to be the final form of the eventual 797, its attributes hint strongly at some of Boeing’s efficiency enablers for its next-generation of medium-range airliners,” Ostrower wrote.

“Elements adapted from existing aircraft are apparent across this early iteration of the NMA design: A 737 MAX-style tail cone, larger 787/777X-sized cabin windows, and a 757/767/777-style windscreen. The door arrangement matches that of Boeing’s last “small twin,” the 767‑200, very strongly suggesting a twin-aisle design.”

Entry into service is projected to occur in the 2024 to 2025 timeframe.

That puts the NMA somewhere between Boeing’s largest narrowbody the 737 MAX 10, (3,215nm range with 230 passengers in a single-class layout), and its smallest widebody the 787-8 (7,355nm range with 242 passengers in a two-class configuration).

And Boeing’s initial estimates for the NMA suggest there might be a market for about 4,000 aircraft. Some aviation analysts, who might define the market differently, have put forward a number closer to 2,500.

The replacement of the 757 and 767s would no doubt be a key plank of the potential market for the aircraft.

However, Tinseth said Boeing has higher ambitions for the proposed NMA than just replacing those older models.

Rather, the NMA is slated to offer airlines the potential to open up or make profitable thousands of routes that cannot be served with single aisle aircraft or were being operated inefficiently with widebody equipment.

“On the NMA you have an airplane that is kind of alone,” Tinseth said.

“It’s an airplane that can disrupt and change and unlock the market so this is about changing airlines’ networks in ways that they can’t operate today.”

“It’s going to open up new markets we haven’t seen before like the 787. That’s the interesting thing about the airplane. It is also the challenge.”

Tinseth said Boeing was in discussions with the three major engine manufacturers – understood to be CFM/GE, Pratt & Whitney and Rolls-Royce – on the proposed 50,000lb thrust engine, adding that the trio were the only suppliers it was currently working with.

Boeing has sought the views of about 50 airlines and leasing companies around the world on what the aircraft should be designed for.

Tinseth declined to go into details of how diverse the range of opinions were, saying only that “those sides were coming together”.

“It’s a little bit like making sausage. It is not a process you want to see but at the end of the day the sausage tastes good,” Tinseth said.

“So you have to really figure out how you blend all of these requirements together.

“We have a very strong idea what it will have to do, how the airplane will have to come together, what kind of configuration, what kind of technologies.”

QANTAS EXCITED ABOUT NMA, BUT ALSO OPEN TO ALTERNATIVES

Qantas chief executive Alan Joyce is an enthusiastic backer of the project.

As far as Qantas is concerned, NMA looms as an ideal replacement for its A330 fleet on domestic routes, both on trans-continental services between Perth and the east coast, and to increase capacity on the main trunk routes out of the increasingly busy Sydney Airport.

Meanwhile, the proposed aircraft could also be deployed on some international routes.

“We are actually excited and I think a lot of carriers are about the potential for that aircraft,” Joyce told media at Qantas’s first half results briefing on February 22.

“It’s still a paper aircraft so Boeing have to define the spec of it, the weight of it, the performance and the price of it, but it looks like it’s being pitched as an aircraft that would work very well in the domestic market.

“It is a lighter aircraft than some of the widebody twin-aisles that we have today. It has a range that’s designed to fly transcontinental and maybe into South-East Asia.”

Joyce said the prospect of Sydney Airport being at capacity within the decade meant having larger aircraft would be the only way to expand.

“We’re now at the cap of 80 movements an hour, we’re full five hours every day already,” Joyce explained.

“By 2026, when this aircraft is proposed to be produced, the airport will probably be completely full so the way to grow is with bigger gauge aircraft.

“What’s also really exciting about it is Boeing are talking about being able to turn it around in the same time as a 737 which means we get really good domestic efficiency out of it.

“So if all that is achieved it’s looking like a very good aircraft in that space.”

Qantas is not putting all its eggs in the NMA basket though.

The airline group has orders for 99 Airbus A320neo family aircraft, which have been earmarked for its Jetstar low-cost carrier (LCC) unit.

And the first aircraft from that order will arrive in mid-2020, when Jetstar Australia and New Zealand begins accepting 18 A321neoLRs that have the range to fly to Bali from Melbourne (2,363nm) and Sydney (2,495mm).

The A321neoLR has a maximum takeoff weight of 97 tonnes and features optional extra fuel tanks to enable the aircraft to have a range of up to 4,000nm.

The first A321neoLR (or A321LR for short) completed its first flight on January 31, commencing a 100-hour flight test program. Certification from the European Aviation Safety Agency (EASA) and US Federal Aviation Administration (FAA) is forecast to occur in the second quarter of calendar 2018, with entry into service before the end of the year.

How those A321neoLR’s perform might shape Qantas’s thinking of what it does when it comes time to renew its fleet of Boeing 737-800 narrowbodies that operate domestically, across the Tasman and on select other international routes.

Jetstar chief executive Gareth Evans highlighted the utility of the A321neoLR at a recent conference in Singapore, telling CAPA the aircraft in the airline’s high-density configuration could be deployed “across the Tasman from the west coast of Australia”.

“It’s that sort of range capability that you are looking into if you are talking about Australia based aircraft,” Evans told CAPA. “Potentially there are things you can do up in the Pacific Islands in the future”.

Separately, Joyce at Qantas’s first half results briefing described the A321neoLR as a “very good aircraft”.

“We want a competitive dynamic to make a decision about what the need is for the long-term replacement of the domestic Qantas fleet,” Joyce said.

“If Boeing decide to produce this aircraft we’ll have alternatives and very competitive alternatives so that will be very exciting for us.”

Industry estimates suggested Airbus’s A321neo was outselling the 737 MAX 9 by a factor of five to one, figures which prompted Boeing to respond with the MAX 10, which is scheduled to enter service in 2020.

Airbus has been keen to point out its Airbus A321neoLR narrowbody, which has been receiving a steady stream of new orders of late, had the potential to be that 757 replacement, particularly for trans-Atlantic routes.

Asked if Airbus had any interest in an engine with 50,000lbs of thrust – which is likely to be the type of powerplant needed for the NMA – Airbus executive vice president and chief of sales, marketing and contracts Eric Schulz said “potentially maybe”.

“It is certainly not something that I have in mind today to say yes absolutely it will go on that airplane to replace that,” Schulz said during a media briefing at the Singapore Airshow.

“As you know the engine thrust is one thing, it goes into an integration on an aircraft, it takes many, many things with it, nacelles, pylons, all kinds of stuff to change and replace.

“Today the least I can say is that I have no personal vision or visibility of the need for Airbus to have an engine on that thrust range.”

Tinseth said those at Airbus “don’t get it” when it comes to Boeing’s NMA.

“They don’t understand what we are trying to do,” Tinseth said.

“They are not talking to the network and fleet planners of the airlines that can really reinvent the way that they can compete.

“I think this airplane could truly disrupt the industry.”

VIRGIN AUSTRALIA, WITH ITS 737 MAX COMING, CAUTIOUS ON NMA

Qantas’s local rival Virgin Australia is a Boeing 737 MAX customer, with an order for 40 of the next generation narrowbody.

First delivery is expected at the end of calendar 2019. Virgin Australia has not specified which variants of the MAX it has ordered “for competitive reasons”.

Virgin Australia chief executive John Borghetti was more circumspect when asked whether his airline had any interest in the proposed NMA.

“We will look at everything,” Borghetti told reporters during Virgin Australia’s 2017/18 first half results presentation on February 28.

“The one thing that is for sure is that the 737 will absolutely be the backbone of the domestic fleet, or the short-haul fleet if you will, for the group for many, many years to come.”

In this part of the world, Air Niugini and Fiji Airways are both also Boeing 737 MAX customers.

Elsewhere there has been an enthusiastic reception to the proposed NMA from a number of airlines around the world.

Lufthansa chief executive Carsten Spohr said the German flag carrier is looking at the proposed aircraft.

“It’s too early, but we are in talks,” Spohr said in early March, according to Reuters.

“They are talking to all major airlines.”

Even Delta Air Lines, not known for purchasing latest generation aircraft and no friend of Boeing following the recent trade dispute over the Bombardier C Series, has expressed interest in the NMA as a potential replacement for its fleet of Boeing 757s and 767s.

“You’re going to see us participate in Boeing’s middle-of-the-market campaign,” Delta Air Lines chief executive Ed Bastian said in February, Bloomberg reported.

“I hope that we’re going to be a launch customer on that program as well.”

Figures from aviation thinktank CAPA – Centre for Aviation indicated the US trio of American Airlines, Delta and United currently had some 390 Boeing 757s and 767s in their fleets.

Further, those aircraft were close to 20 years old.

“As fuel and maintenance costs

rise on those aircraft those three airlines will put pressure on Boeing to firm its commitment to design a jet to fill the space between the 737 narrrowbody family and its 787 widebodies,” CAPA said in a research note in early March.

“Airlines have been urging Boeing for quite some time to improve its offerings for small twin aisle replacements, and their voices are only growing louder.”

FLEET PLANNERS EXCITED

Tinseth said his team of 25 people at Boeing with network and fleet planning expertise had received plenty of positive feedback about the proposed aircraft.

“I’ve gone into a number of airlines with the NMA and listened to them. The fleet planners can’t help themselves, they get so excited,” Tinseth said.

“Where you get the real excitement is when my network and fleet team connects with their network and fleet team and then they start to take a look at networks and what it can do and how they can do this and how they can disrupt.

“It’s going to be pretty exciting.”

Industry watchers say Boeing could launch the NMA later in 2018.

For now, work at Boeing’s NMA program office that was formally established in 2017 to look at the development of the aircraft continues, while discussions with airlines and their network and fleet planners is ongoing.

“Can you build an airplane at a cost that justifies this price in the market? And that’s where a lot of our time and attention is being spent right now,” Tinseth said.

“So get the technologies right, get the configuration right and then figure out can you be profitable at it.”

“I’m a marketing guy so what I am trying to do is figure out the value the product brings in the market and then I turn it over to the engineers and the program people, they calculate the price they can build it at. It all has to come together in order to make the business case work.”

Paule

says:What ever configuration the 797 is, it will have to be a twin isle. My memories of the 757 in USA are of excruciatingly long boarding times as people bring onboard massive ‘carry-on’ luggage. Having just returned from Europe where a significant number of airlines use the A321 as a mid-range aircraft, it’s not unusual for boarding to commence 50 minutes before departure! There is no way Qantas or Virgin can sustain those turnaround times in Australia, particularly between SYD/MEL/BNE.

John Brett

says:In respect of the timeline story on the B787- series aircraft the writer claimed that All Nippon Airways was the launch customer of the type?

I have always understood the launch customer to be Air New Zealand? I presume that I might have my facts wrong?

John Brett

Copernican

says:ANA was the launch customer for the first model to fly, the 787-8. Air NZ was the launch customer for the second version, the B787-9, which has more seats and longer range. Singapore is the launch customer for the third and final model, the B787-10, which has the most seats and the shortest range of the three variants.

Daniel

says:Wouldn’t a larger 737 and a smaller 787 cover the market without developing an entire new plane?

Marc

says:@ Daniel

One doesn’t have enough range and payload, the other too much range and payload versus passenger numbers for medium haul work/versitility.

wellyboinz

says:John Brett…. you are half correct.

Air New Zealand were a launch customer, but for the 789 instead. Air New Zealand were originally the launch customer of the 788, but when it got delayed, they opted for the 789 instead.

All Nippon Airways was the official launch customer of the 788, and due to this were able to be the first airline to bring the 789 in to service, pipping Air New Zealand by 4 days.

Allan

says:Let’s hope Boeing get the cabin width right with this one. I’m surprised passengers even consider 9-across 787 or 10-across 777 with their narrow seats. Even 737 is only bearable on short flights. Boeing needs a size which discourages airlines from using the squeeze factor yet again to make its aircraft less comfortable than Airbus.

Stephen Boyce

says:John Brett All Nippon launched the boeing 787-8 Air NZ launched the boeing 787-9 which has been the most popular boeing 787. I hope Qantas orders the boeing 796 to replace airbus a330 and boeing 737 in time. after thet order boeing 777-8 and boeing 777-9 to replace boeing 747 and airbus a380

Gary

says:John, I think ANA was launch for the B7878 and therefore launch of the series whilst ANZ was launch for the B7879.

Gary Vermaak

says:Bring back the B757. A B757Max (NEO) is the best candidate for the job!

The next best (& a twin isle option) would be a B767 with GEnx 2b engines.

Anthony Tolhurst

says:Nope! The B767 is beginning to be missed by the flying public. B737 whatever version is a narrow tube, carrying 200 some pax of a plane with its heritage in the 60’s, the B787 an international conveyance; the (797) a sensible domestic/intercontinental twin aisle airplane that should out-767 the 767 in terms of space, capacity and efficiency. Bring it on Boeing!

Chris

says:John Brett, All Nippon was the launch customer for the Boeing 787-8 – the first variant of the 787 on 26th October 2011. Air New Zealand was the launch customer for the Boeing 787-9 on 8th July 2014 – almost 3 years later.

Lachlan

says:@John Brett

As far as I’m aware ANA was the launch customer for the 787-8, and NZ was the launch customer for the 787-9.

Holden

says:Still have to believe that the NMA is being overlooked as an opportunity for Qantas to connect new regional city international routes (akin to what Boeing discusses above) and not just centred on routes from the Australian major city hubs.

It’s been said many times before in these forums – Hobart, Canberra, Newcastle, Sunshine Coast, and Townsville – all are crying out for new direct international services, and the NMA is very likely to be the missing piece.

Existing aircraft options are either too big for these cities, or too range restricted.

It seems like a wasted opportunity just finding new routes based on Australia’s hubs, and flouts some of the utility Boeing’s Tinseth advocates.

It does still seem however that 225-275 is bigger than the supposed void in the market, and at that size might just kill the pax/range/payload combination to open up new routes out of regional Australia.

Brad

says:From a passenger point of view something akin to a 767 or A310 is ideal but getting really good aerodynamics is a lot harder on a short widebody compared with a long narrowbody.

There are lots of competing requirements for the 797/NMA and realistically it cannot be all things so something will have to give. Some airlines are after a smaller medium range aircraft whilst others want something optimised for busy short range missions. Some want quick turnarounds which indicates a widebody is preferred but others demand it fit into gates currently used by 757s and 737s.

Hopefully by the end of the year Boeing will define some basics such as cabin width and wingspan. From there, airlines will truly be able to say if the 797 is of interest or if the A321 or 787 better meet their needs.

Chris

says:I think the B797 is the B767 replacement and lead in for the B787 family as a linking aircraft between the B737max and B787 families. Reading whats online, the B797 will have a similar flight deck to the B787 to allow B797/B787 pilot utilization.

The B797 will most likely be twin aisle for 220 to 280 passengers with 2-3-2 seating configuration in a 2 class layout and a range up to 5,980nmi (11,070 km) in 2 models.

Looking at the Australian/New Zealand market, the B797 would be used for BNE/SYD/MEL and BNE/MEL/SYD to PER domestic services, Trans Tasman, Trans Pacific Australia to Fiji and Honolulu and Asia routes for Qantas and Virgin Australia.

From Air NZ point of view, if they purchase the B797, I see them being used on the Trans Tasman and Asia routes and possibility New Zealand to Fiji, Papaete and Honolulu supplementing B789/B773 services.

The B797 would be great for LLC’s in 1 or 2 class configuration operating B737 using the B797 for regional or medium long routes.

For international LCC carriers like Scoot could benefit with a B797/B787 fleet to ‘mix n match’ aircraft types on medium and long haul services.

With regards to the A321neo/A321neoLR, this is in essence the B757 replacement. At stage, Airbus does not have a B797 equivalent model unless the proposed A322 becomes a 2 twin aisle aircraft, which I doubt. Airbus could develop a A360 as a B797 equivalent being a better option, as a link between A319/A320/A321 and A330/A350 families.

Trogdor

says:@Daniel – “Wouldn’t a larger 737 and a smaller 787 cover the market without developing an entire new plane?”

Essentially the 797 is a response to the yawning gap that has opened up between the 737/A321 and larger, long range twins. The planes that used to operate in that space – the A300/310 and 757/767 are all out of production.

A330s and 787s are simply too large and heavy to be made efficient on shorter routes (which is why Qantas dropped so many dreamliner orders some years back), while the smaller twins can’t be stretched beyond where they are now.

The interesting question is whether Airbus thinks the market is big enough to justify a new plane of its own, and play catch up with the 797 in the same way Boeing did with the 767 when the A300 took off.

Random

says:Let me preface this by saying the manufacturers and airlines are smart and typically well researched.

Boeing quotes the following figures –

737Max10 – 2 class (188-204 pax).

787-8 – 2 class (242 pax).

I am wondering how 225-275 pax sits within that perceived void – that seems to favour being too big, and encroaching well into the bottom end of the B787?

Surely the void is a configuration approximately 2 class 200-225 pax – which would take the aircraft closer in size to B752/B762 and not jump straight up to B753/B763 size.

I know airlines often scream that their aircraft are too small, but we (and the airlines themselves) seem to forget that frequently they have a glut of capacity too and lament their aircraft being oversized.

It just seems odd that the sizing doesn’t really fit neatly into the gap they show via aircraft specs.

John Reid

says:I flew a fair amount on 757s of Ethiopian and others out of Rome. I don’t understand why anybody wants to repeat that “737-twice-as-long” feeling. 767NEO, yes!

Trogdor

says:@random – it’s not so much the passenger numbers but the range.

Operating a 797 with 250 people on a route such as Sydney to Perth (or even more so Sydney – Melbourne) will ways be more efficient than using a 787 on the same route. I suspect that in due course we will get a further 797 stretch that can take 300 people over a similar range to an A321LR

Gary Vermaak

says:Rather apt title for this article, don’t you think? Sums up the airlines’ #MoM segment strategy very well – squeeze more and more pax into a single isle aircraft for longer and longer flights!

What the airlines really want is a twin isle for easy boarding and disembarkment but with the economics of an A321NEO / A321LR

Darren

says:Yep,

The 787 will be a smaller version of the 757!

Sam

says:@gary

I frequently fly full A321s (230 pax) and we can turn them around in 40 mins. If anything it’s usually the containers coming off and on which takes longer.

Chuck

says:@Trogdor – I have to agree with Random and Holden.

I think it’s actually both pax numbers AND range.

B737MAx10: 2 class – 188-204 pax and 3300nm range

B787-8: 2 class – 242 pax and 7355nm range

Older aircraft like B752/B762ER:

B752: 2 class – 200 pax and 3915nm range

B762ER: 214 pax and 6900nm range

A321NEO/LR: 2 class – 206 pax and 4000nm

A solution that uses a range/payload combination that sits in between B752/B762ER would seem to give best coverage of the perceived ‘void’. (ie – a new aircraft encompassing 190-225 pax in 2 class; approx 5500nm range).

Looking at what Randy Tinseth has said above, there are a vast number of ‘new’ route combinations waiting to be exploited. Many of these are not large volume markets – they are just city pairs that are yet to be connected, and in many cases it’s because existing aircraft are both too range limited, just too big or both. That is absolutely the case for international connections from Australian regional cities, and likewise a huge number of direct connections across the Atlantic, along with existing and new city pairs within Asia.

Building the NMA/B797(?) so it ends up significantly overlapping the bottom of the B787 market makes no sense what-so-ever. By advocating potential size growth up towards 300 seats Boeing just risks undermining the B787-8. At that size the NMA/B797(?) would absolutely kill the B787-8 if it achieves A321LR ecenomics. Boeing is better off being in the middle ground (190-225pax; 5500 nm range) which will give it ample opportunity grow or shrink any new airframe so that it cusps existing Boeing aircraft.

Scott

says:I agree with random the gap is approx 220-240 2 class with short range weight savings v 788

Marcus

says:Great article generating a lot of discussion.

Trogdor

says:@Chuck – interesting points.

But I think there’s a segment you’ve overlooked – there’s a lot of airlines that are running 2-6 hour long flights that want something substantially bigger than a 737/A320 but simply don’t need the range (and associated additional costs) of a 787.

Having a 797 that edges pretty close to the seating capacity of a 787-8 but falls short on range isn’t any different to having a 787-10 that sits close to the seating capacity of a 777-8 (but likewise falls short on range).

While the current long/thin routes get the publicity, I think there’s an awful lot of airlines (including Qantas) who will pick up 797s to run shorter routes as a 737 replacement, especially at airports where slots are scarce but passengers numbers are increasing.

Ted

says:Some of the specs listed here are remarkably similar to A310-300.

A310-300 – MZFW 116,000kg (2 class 220 pax, 5100nmi range),

Interesting are the A321LR specs, and particularly the MZFW & MTOW difference between narrow and widebody.

A321LR – MZFW 73,000kg (2 class 206 pax, 4000nmi range).

A big factor in effectively ‘iterating’ the design of this new Boeing aircraft is going to be MZFW (and corresponding MTOW). B757-200 was 84,000kg MZFW, and B767-200ER was 118,000kg MZFW – that’s a statistically significant difference.

However Boeing iterates the design, it will be trying to find an MZFW and MTOW that is considerably lower than A310-300 or B767-200ER. Composites and new alloys are technically limited in how much they can contribute – a safe figure would be the generic 20% weight saving over aluminium aircraft that Boeing used for B787, but that only gets an NMA/B797 MZFW of 93,000kg – still 9t heavier than B757-200 and 20t heavier than A321LR.

This will require stripping out (lightweighting) more weight from MZFW (primarily undercarriage and wing designs) but on an order of magnitude not yet seen – a widebody with narrowbody-like MZFW is really what the airlines want.

The B787-8 MZFW is 161,000kg – an order of magnitude larger again – which shows why a revised / truncated version of the B787-8 is not favoured as a solution to the market gap.

Random

says:What we are effectively seeing here in this forum are 2 different aircraft – both with seemingly viable markets.

I’m not sure that one airframe can do both roles, unless the commercial team at Boeing are miracle workers.

Aircraft 1 –

Oversized (250-300 seat) domestic-focussed lightweight widebody, that gives extra pax & freight capacity over B738/A320, with easy transcontinental range (what Qantas seems keen on).

Aircraft 2 –

Undersized (200-230 seat) international-focussed widebody, that gives significant extra range over B737/A321 without the weight penalty of jumping up to A330/B787 (what 757 & 767 officianados seem to think is missing).

Can these two requirements live within one airframe / one aircraft DNA without unduly compromising or diluting the basic mission of the other?

Marty P.

says:Wow! What a puzzle. As an oldie in the business, for what its worth, A B767-200LR-NEO could be the answer.

A B767-200 minus a number of frames could achieve the required length. It already has the fuselage width.

Thrust rated GE’s and the inclusion of folding winglets-as with 777x on new wings. I’m certain Boeing still

holds the B767 jigs and frames so it would appear a much more beneficial situation financially. Cockpit as in

787/777 for easy conversion for pilots. Common rated! Good luck Boeing, you have a big decision to make.

JKH

says:Pax, Range + Turnaround time. If only pax comfort could be a consideration as well!

767 2/3/2 economy seating config was the best. 787 width and 3/3/3/ is shameful.

It would be excellent to be able to fly in a smallish w/b aircraft on shorter hops and short long haul hops versus crummy N/B aircraft. 737’s are feral from a passenger perspective but the economical work-horses which is all that airlines care about.

AlanH

says:So much of this discussion centres around what the airlines want. Are any of them thinking about what the pax might want? The NMA, if it actually takes off, must be a mid-sized twin-aisle (like the A330/B767) for the sake of passenger comfort and travel experience and easier/quicker ingress/egress surely. Long, thin sardine tubes are not what pax want for extended flights. The day of the B757 is long past.

Ron Lambert

says:AHHHh the DC-8 is back !!!