Boeing has revised upwards its market forecast for aircraft deliveries over the next 20 years, with the rise of low-cost carriers (LCC) and emerging markets fuelling demand for passenger travel and cargo volumes.

Boeing has revised upwards its market forecast for aircraft deliveries over the next 20 years, with the rise of low-cost carriers (LCC) and emerging markets fuelling demand for passenger travel and cargo volumes.

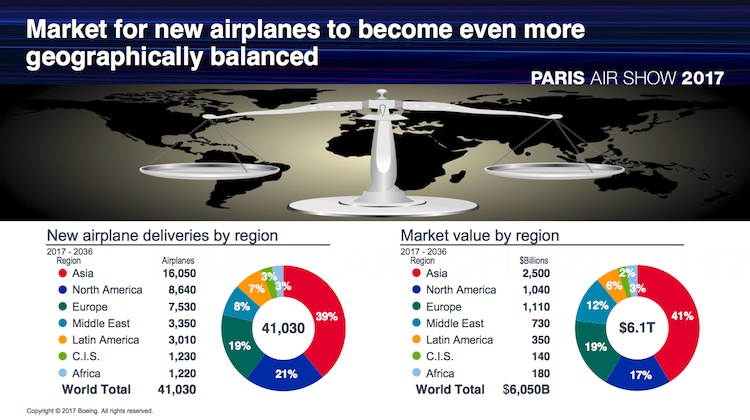

The Boeing Current Market Outlook (CMO) for 2017-2036 said 41,030 aircraft would be delivered over the next two decades, with 57 per cent to be used for growth and the remainder as replacement of older airframes. The forecast represented US$6.05 trillion worth of aircraft at list prices.

The forecast is contained in the manufacturer’s 2017-2036 Current Market Outlook (CMO) that was presented at the Paris Airshow on Tuesday (European time).

It is an increase of 3.6 per cent from 39,620 new aircraft deliveries predicted in the 2016-2035 CMO published a year ago.

Boeing Commercial Airplanes vice president of marketing Randy Tinseth said passenger traffic was expected to grow 4.7 per cent a year for the next 20 years.

“The market is especially hungry for single-aisle airplanes as more people start traveling by air,” Tinseth said in a statement.

There was an upward revision for the single-aisle (90-230 seats) market, with 29,530 new aircraft expected to be delivered over the next 20 years, up 4.9 per cent from 28,140 in the 2016-2035 CMO.

“These new airplanes will continue to stimulate growth for low-cost carriers and will provide required replacements for older, less-efficient airplanes,” the 2017-2036 CMO said.

The report noted the LCC “business model’s success for short-haul routes is evident in the current aviation market”.

Further, the rapid expansion of LCCs in Asia had been a key contributor to the overall growth in the short-haul market since the early 2000s, the report said. In some home markets the penetration rate for LCCs had risen to more than 50 per cent amid double-digit percentage growth rates over the past decade.

“While established network carriers continue responding to aggressive competition posed by the low-cost business models, our current backlog and forecast project that LCCs will penetrate further into the short-haul market and increase regional connectivity,” the report said.

Single aisle aircraft was expected to comprise about 75 per cent of the global fleet by 2036, compared with 64 per cent today, the report said.

LCCs were expected to total one-third of the world’s single aisle fleet by 2036, up from about a quarter currently.

The outlook for regional jets (less than 90 seats) and small widebody (200-300 seats) was lower compared with the prior year.

And in a change from previous CMO, the 2017-2036 no longer separates the medium widebody (300 to 400 seats) and large widebody (more than 400 seats) segments.

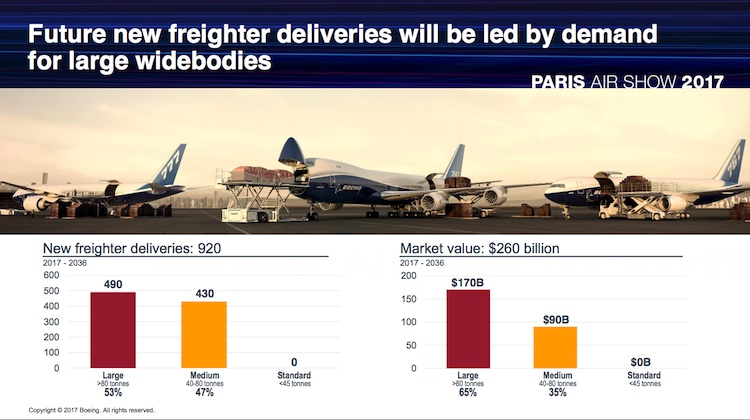

Instead, it forecasts demand for 3,160 aircraft in a new combined medium/large widebody segment, as well as an expected 920 widebody freighters.

Boeing has traditionally regarded the very large aircraft segment, featuring the likes of the Boeing 747-8F (freighter), 747-8I (passenger) and Airbus A380, as a small market, believing just a handful of airlines around the world had the route structures and capabilities to successfully utilise an aircraft with more than 400 seats.

“With more airlines shifting to small and medium/large widebody airplanes like the 787 and 777X, the primary demand for very large airplanes going forward will be in the cargo market,” Boeing said.

The report said the percentage of large size passenger widebody aircraft had declined from 32 per cent of the in-service fleet in 1996 to 11 per cent today.

“By 2036, we anticipate the large segment will be less than five per cent of the passenger widebody fleet,” the 2017-2036 CMO said.

Production rates of both the A380 and 747-8 have been cut in recent times amid weak demand for these aircraft.

Airlines in Asia Pacific represented about 40 per cent of expected new deliveries over the coming 20 years, with 16,050 new aircraft tipped to enter service in that period. The forecast for Asia was up from 13,460 new deliveries in the 2014 CMO.

The region is expected to be the biggest travel market in the world and tipped to represent about 40 per cent of global passenger traffic by 2036, the CMO said.